General Motors Co.'s annual meeting last week lacked what used to be an essential element: shareholders. For the first time, the carmaker held the gathering virtually, answering questions investors submitted online, joining companies like Lululemon Athletica Inc., Netflix Inc., and Intel Corp. in stopping physical events.

Not all investors were happy.

John Chevedden, a shareholder activist, called on GM investors to vote against the appointment of three directors in protest of the automaker's decision to ditch in-the-flesh gatherings.

“An in-person annual meeting is a motivator of good performance by management and directors,” Chevedden said in a filing. “Who wants to stand in front of a live audience and explain shrinking sales, epic recalls, and loss of market share? It is so much easier to explain it to a microphone.”

GM spokeswoman Juli Huston-Rough defended the practice. Online meetings “provide better opportunity for more shareholders to participate, regardless of where they live,” she said in an emailed statement. “For many shareholders, attending a live meeting isn't feasible because of geography or travel expense.”

In the U.K., the Investment Association—a trade body that represents portfolio managers who collectively oversee about $10 trillion of assets—has said it doesn't support virtual-only meetings. Lululemon's billionaire founder Chip Wilson, the biggest individual shareholder, has complained that the company's switch to the format in 2016 thwarted his ability to ask the board uncomfortable questions.

Still, the practice is becoming more prevalent.

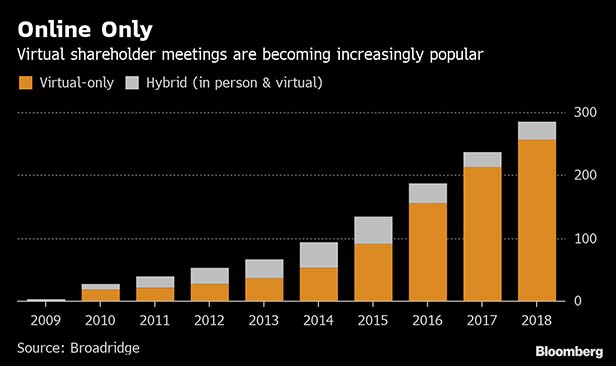

Broadridge Financial Solutions Inc., which offers firms a platform to host online-only meetings, supported 257 such events in 2018, up from 212 in 2017 and just one in 2009, when it introduced the product. Proxy adviser Institutional Shareholder Services (ISS) is currently tracking 186 virtual-only meetings that have already happened or are scheduled for later this year.

Supporters of virtual meetings say the cost savings can be significant and allow shareholders worldwide to participate.

“Companies aren't doing it to hide; they just want to make the meetings more useful,” said Cathy Conlon, head of corporate issuer strategy at Broadridge. “It allows retail investors to have access to the company. People complaining about virtual meetings are generally those who already have access to the company.”

Marc Goldstein, head of U.S. research at ISS, said the most investor-friendly solution would be a hybrid meeting combining a live event that's also carried online. For many firms, that defeats the purpose of making the virtual switch.

U.S. shareholders who object to such shifts have little recourse. While companies that wish to make the switch from physical meetings have to put that to a shareholder vote in Britain and some other markets, there's no such requirement for most U.S. firms, according to Goldstein.

For now, most companies haven't abandoned traditional shareholder meetings, which give mom-and-pop investors a platform to voice their ideas and concerns. That can make for some awkward moments for executives. At Bombardier Inc.'s event in Montreal last month, a shareholder who said he had held the stock for almost six decades asked why the plane and train maker, which is in the middle of a turnaround plan, hasn't paid a dividend for years while rewarding top executives with “staggering” pay. His comments drew some applause.

But virtual-only meetings can also be awkward. At Lululemon's meeting, Wilson submitted eight questions, most of which focused on whether the board had deliberately ignored his questions at previous gatherings. This time, the company offered answers to most of his questions and still managed to wrap up the entire proceeding in about 20 minutes.

— With assistance from David Welch and Sandrine Rastello.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.