Having spent a number of years both in the equipment-leasing industry and as a corporate treasurer, I am still surprised by how often companies appear to just enter into lease transactions with no more foresight than the stroke of a pen. In many cases, they enter a deal worth hundreds of thousands, or even millions, of dollars over multiple years after very little review or analysis of the lease transaction's terms and true costs over time.

Having spent a number of years both in the equipment-leasing industry and as a corporate treasurer, I am still surprised by how often companies appear to just enter into lease transactions with no more foresight than the stroke of a pen. In many cases, they enter a deal worth hundreds of thousands, or even millions, of dollars over multiple years after very little review or analysis of the lease transaction's terms and true costs over time.

Most of the corporate lease-procurement effort revolves around negotiation of the equipment's purchase price at the beginning of the lease. When that is completed, the supplier's captive lease representative steps in with a lease contract, which the buyer immediately accepts without any meaningful review or pushback.

Such an approach may leave a considerable amount of money on the table. Quite often, lessees negotiate a good cash purchase price, only to relinquish much of those savings in the lease financing. The lessee's finance staff don't do an adequate analysis because they don't have the time or expertise, which enables the vendor to recapture margin it forfeited in price negotiations.

So, how can a treasury or finance team know whether a lease is good or bad?

There are two parts of a lease transaction to consider in answering this question: the total lease price that the lessor offers up as part of the deal, and the terms and conditions of the lease contract. This article will focus on the lease pricing; we will subsequently publish a separate article about analysis of the lease contract itself.

Fair Market Value

We will focus on a fair market value (FMV) lease, as this is the typical lease structure for most equipment. Pricing on an equipment lease transaction is usually quoted using a lease rate factor, or LRF. Arriving at the LRF is a simple calculation. The periodic lease payment is divided by the initial cost of the equipment; the resulting percentage is the LRF.

The LRF is a well-established standard across the leasing industry. The beauty of the LRF is that a company can apply the percentage to different equipment options and very quickly figure out how much it would need to pay every month or quarter. The downside is that's all the information the LRF provides.

When a lessor provides a price quote for an FMV lease, its LRF is driven by three main components: the length of the lease term; the implied cost of money the lessor is receiving over time rather than at the outset of the lease; and the lessor's estimate of how much residual value the asset(s) will retain at the end of the lease term. In most cases, the lessor is not going to want to disclose how it arrives at the LRF it quotes. The good news is that a corporate finance team can easily deconstruct the LRF to get a sense for where the numbers come from.

In fact, dissecting every lease quote is a best practice for companies that engage in equipment leasing. The PMT formula in Microsoft Excel can provide a very good understanding of how the lessor arrived at its LRF, or the lease's periodic payment. The formula looks like this:

=PMT(rate,nper,pv,fv,type)

where

- PMT is the amount of each periodic payment. (Note that it is a negative value in the Excel formula; think of it as negative because the cash is leaving you.)

- rate is the interest rate driving the periodic payment. (Note that it must reflect the frequency of payment—so rate for a monthly payment would be the annual interest rate divided by 12.)

- nper is the number of periodic payments in the lease transaction.

- pv is the initial cost of equipment in the lease.

- fv is the expected residual value of the equipment at the end of the lease term. (Note that fv is also a negative value in the Excel PMT formula.)

- type is determined by whether payments are made in advance or arrears. (If the payment period is monthly, an advance payment for January would be due on January 1, while an arrears payment would be due January 31.)

Here's how the calculation would work. Suppose you were looking to lease a forklift and a prospective lessor gave you a bid with these features:

- Initial purchase price of the forklift (pv)—$25,000

- LRF—2.87%

- Term of the lease (nper)—36 months, with one payment per month

- Payment timing (type)—advance

To determine whether this is a good deal, you can back into the missing numbers.

You don't know what the lessor used for the implied cost of funds or the residual value of the forklift, so you need to make some assumptions. When I am performing this calculation for my company, I estimate a reasonable cost of funds for my organization based on our current credit profile.

Because the lease term in this example is 36 months, the question you would ask is: What interest rate would we have to pay if we went to the debt market today and borrowed $25,000? If your current interest rate for 36-month debt is 5 percent, you could reasonably estimate that your annual interest rate in the PMT formula should be 5 percent. Then, because you will be making payments once a month, you need to divide the annual interest rate by 12 to reach the rate number for your monthly payment. This does not yield a perfect analysis; nevertheless, it provides important insights into the economics underlying a particular lease transaction's LRF.

With rate determined, the only variable still missing in the Excel PMT formula is the residual value. The PMT formula looks like:

=PMT(.05/12,36,25000,fv,1)

where

- rate = 5% (i.e., .05) divided by 12

- nper = 36

- pv = $25,000

- type = advance, which is represented by a 1 in Excel (arrears would be represented by 0)

The good news is that because you have the purchase price and the LRF, you can calculate the PMT value, the monthly payment implied in the quote. Just multiply the 2.87 percent LRF by the $25,000 pv, and you find that you will be paying $717.50 every month for the next 36 months. Having the correct answer to the payment amount means you can test different values for any variables you are missing, and can determine whether a particular calculation of the PMT formula is correct.

For example, if you guess that the residual value of your forklift after 36 months will be 10 percent of its purchase price at the beginning of the lease contract, or $2,500, you can enter -2500 for fv in the Excel PMT formula (remember that the fv value in Excel is a negative amount). Running the PMT formula with these values—

=PMT(.05/12,36,25000,-2500,1)

—results in a PMT value of -681.92, which is equivalent to a monthly payment of $681.92. This is lower than the actual monthly payment of $717.50.

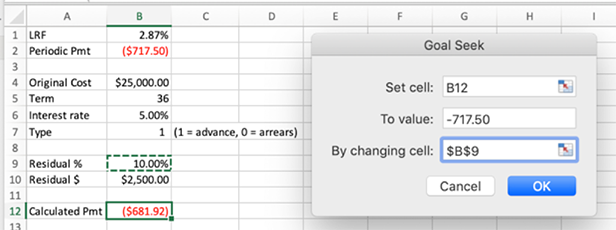

From here, you can use Excel's "Goal Seek" function on the Tools menu to find the fv value that will result in a monthly payment of $717.50. Goal Seek is a great function; it can quickly run through thousands of numbers to find the right one. In this example, you can specify that you want the Goal Seek function to modify the fv number so that the PMT formula results in a value of -717.50.

Note that you will need to set up two separate cells in Excel for this to work. One cell should hold the actual number for the residual value (-717.50); the PMT function requires the dollar amount. The other cell should hold residual value as a percentage of the equipment's original value (.10); the Goal Seek function requires a percentage.

With all these considerations, the Goal Seek formula would look like this before running the analysis:

Cell B12 is the calculated payment that we want to become -$717.50 to match the monthly payment amount offered by the lessor. We get to the right monthly payment by modifying cell B9, the expected residual value expressed as a percentage of the original purchase cost.

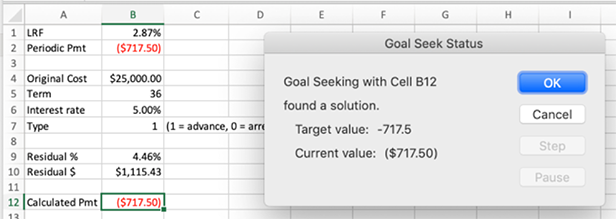

After the "OK" button is pressed to run the Goal Seek function, the numbers look like this:

As you can see, the result of this calculation is very interesting. If we're correct about the lessor's implied interest rate of 5 percent, the residual value built into the LRF is only $1,115.43, or 4.46 percent of the original purchase price. That seems like a low value for a $25,000 forklift after just three years. This is a red flag that the lessor may not be offering a good deal on the lease.

When you see this type of red flag, you may want to continue analyzing the deal by changing other variables that you estimated. In this example, it would make sense to re-run the calculations with a different interest rate. Doing so could provide a sensitivity analysis showing how the residual value would change under different interest rate assumptions.

See also:

One more idea for tightening up the estimate of the cost of funds the lessor is including in the LRF is to ask the prospective lessor for two LRFs—one for an FMV lease and one for a full-payout ("dollar buyout") lease. The full-payout lease, by definition, is calculated such that the equipment has a residual value of $1 at the end of the lease term. A corporate finance team evaluating a full-payout lease can use the PMT formula to definitively solve for the cost of funds that the lessor has priced into the full-payout LRF. They can then plug this realistic rate figure into the analysis of pricing on the FMV lease to solve for that lease's residual value. An unreasonably high interest rate is another potential red flag that a lease offer is not a good deal.

How to Use What You Learn

A finance team that finds a pricing red flag on a lease they are considering should show their analysis to the lessor and push for a lower LRF (i.e., lower monthly payment) for the deal. These calculations are a great negotiation tool, and that's not their only use. My advice is for companies to evaluate every lease in this way, to make sure they are always getting a good price—not only on the equipment, but also on the lease.

Ultimately, the best mechanism for negotiating a good lease is to competitively bid the transaction among a variety of lessors. An investment-grade company whose assets aren't particularly specialized should have no trouble finding lessors to compete for its lease business. Broad-based competition is the only way to ensure that the resulting deal is the best available. And the bigger the deal, the harder lessors will fight to win.

Ultimately, the best mechanism for negotiating a good lease is to competitively bid the transaction among a variety of lessors. An investment-grade company whose assets aren't particularly specialized should have no trouble finding lessors to compete for its lease business. Broad-based competition is the only way to ensure that the resulting deal is the best available. And the bigger the deal, the harder lessors will fight to win.

A finance team can run this competitive process in-house or leverage an online leasing marketplace, such as the LeaseAccelerator Sourcing platform. Either way, getting multiple bids will give decision-makers a clear picture of the current market price for a particular lease given the company's credit rating. They can measure the value of competing leases by comparing the LRF of the lowest bid against the LRF of the average bid.

It's a good idea to save leasing bids indefinitely to retain a permanent, long-term view of the company's lease-bidding experience, in order to track performance over time. In my opinion, this is a leasing best practice. Finance managers, and their senior management team, can rest assured that they are doing everything within their power to enter into fair lease transactions. They have the audit trail for every transaction and market data to support their decisions.

Data is crucial in negotiating equipment leases. The companies offering the leases engage in these transactions every day. Compared with the corporate finance teams entering transactions as lessees, the lessors will always have the upper hand in terms of experience and expertise. That said, treasury and finance groups who understand the different inputs that each lessor is using to determine the LRF it offers will know that no lessor can take advantage of their organization. They will have the supporting analytics for every transaction.

Ingemar Lanevi is vice president and general manager of global lease sourcing solutions at LeaseAccelerator. He has more than 25 years of experience leading finance, treasury, leasing, and strategy functions. He also has extensive experience in structuring complex financial transactions, financial and fiscal planning, capital market fundraising, budgeting and forecasting, strategic business development, IT system implementations, and merger and acquisition (M&A) funding.

Ingemar Lanevi is vice president and general manager of global lease sourcing solutions at LeaseAccelerator. He has more than 25 years of experience leading finance, treasury, leasing, and strategy functions. He also has extensive experience in structuring complex financial transactions, financial and fiscal planning, capital market fundraising, budgeting and forecasting, strategic business development, IT system implementations, and merger and acquisition (M&A) funding.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.