Most senior finance executives at U.S. businesses believe the United States will be in an economic recession by the end of 2020, and 76 percent predict a recession by mid-2021, according to fourth-quarter results from the Duke University/CFO Global Business Outlook.

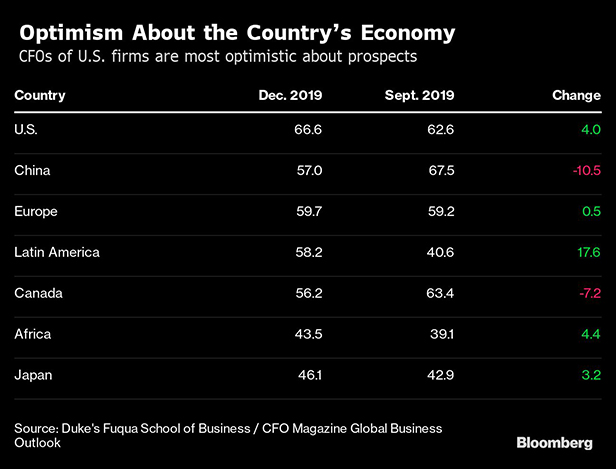

But, even with a recession on the horizon, U.S. CFOs lead the world in terms of their optimism about the general business environment.

At the company level, they say their organizations are taking steps to mitigate the effects of a recession by increasing their cash holdings. "Hoarding cash and reducing debt are the most obvious tactics to dull the blow of a recession," says Campbell Harvey, professor at Duke University's Fuqua School of Business.

See also:

- How Corporate Treasuries Are Seizing the Moment

- Recession on the Horizon?

- And the on-demand webcast: How Corporate Cash Management Is Evolving

Globally, U.S.-based firms have the highest degree of optimism about their own company. Capital spending is expected to rise 4.7 percent, and wages are anticipated to grow 4.4 percent next year, the largest increases since the Q1/2019 survey.

However, economic uncertainty remains a major concern among CFOs around the world.

The Duke University/CFO Global Business Outlook survey has been conducted for 95 consecutive quarters. The survey period ended December 6 and generated responses from more than 800 CFOs, including nearly 500 in North America, 87 from Asia, 87 from Europe, 139 from Latin America, and 40 from Africa.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.