Treasury teams are becoming increasingly strategic, but most are ill-prepared to leverage the technologies that can move them further down this path. That's the headline news from Deloitte's "2019 Global Treasury Survey," released late last year.

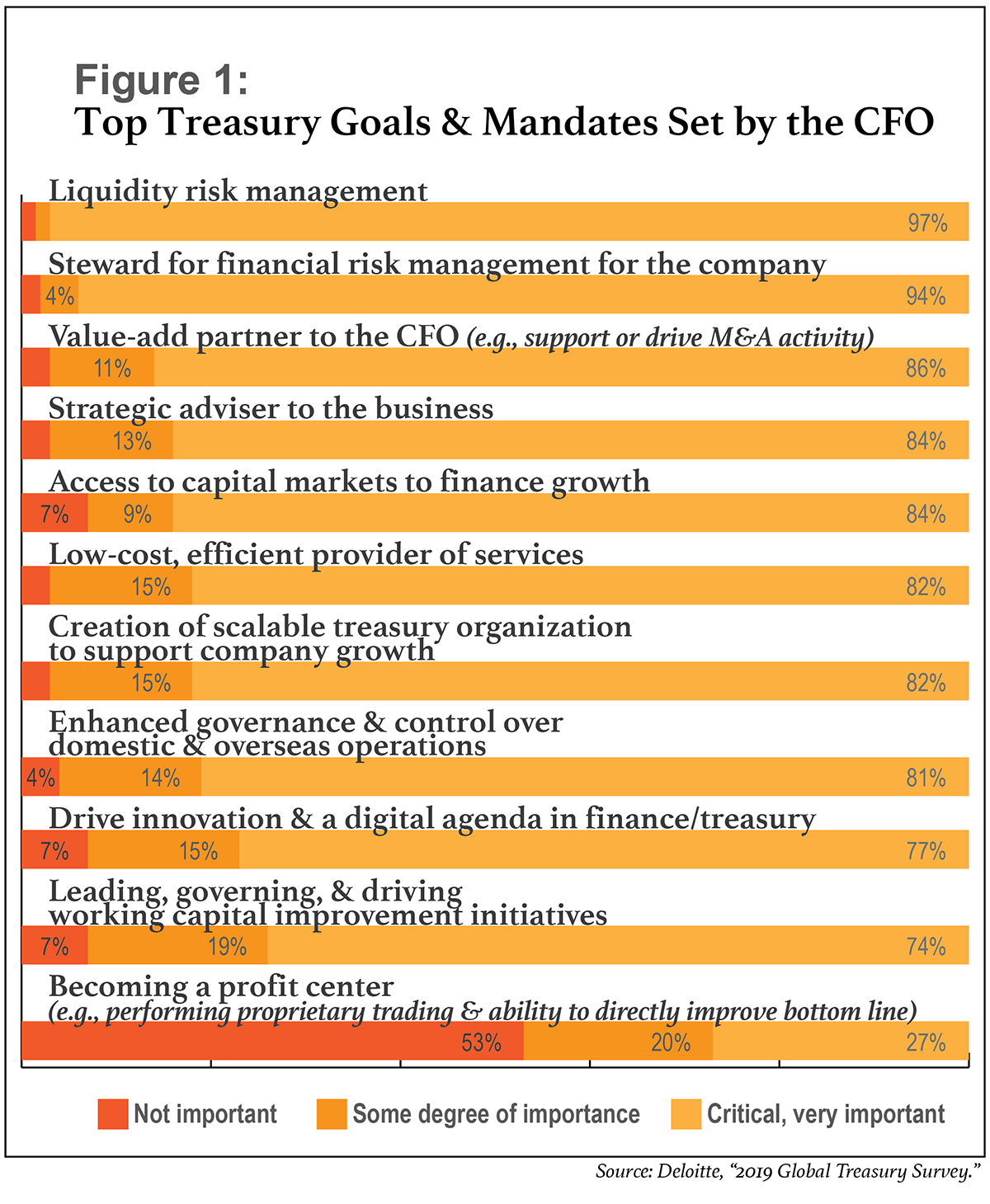

Deloitte surveyed treasury professionals from an array of different industries, who are located primarily in Europe, the Asia-Pacific region, and the Americas. Nearly two-thirds of respondents (62 percent) reported that visibility into global operations, cash, and financial risk exposures is their biggest strategic challenge, followed by liquidity (57 percent) and currency volatility (50 percent). These results make sense because almost every respondent (97 percent) said liquidity risk management is a critical or very important mandate for their function, and 94 percent placed high importance on serving as a steward for financial risk management for the company. (See Figure 1, below.)

At the same time, 86 percent rated being a value-added partner to the CFO as a critical or very important treasury function. Eighty-four percent said the same thing about being a strategic adviser to the business. And 47 percent attribute at least some degree of importance to becoming a profit center. Compared with Deloitte's 2017 survey, all three of these proportions are trending upward.

At the same time, 86 percent rated being a value-added partner to the CFO as a critical or very important treasury function. Eighty-four percent said the same thing about being a strategic adviser to the business. And 47 percent attribute at least some degree of importance to becoming a profit center. Compared with Deloitte's 2017 survey, all three of these proportions are trending upward.

In fact, the proportion of treasurers reporting that becoming a profit center is a critical task for their team has nearly doubled since 2017, up from 15 percent to 27 percent. Melissa Cameron, finance advisory leader for Deloitte, advises reading that statistic in context. "I think for most companies, becoming a profit center is not about proprietary trading," she says. This year's survey added a descriptive phrase providing examples of how a treasury function might become a profit center: "performing proprietary trading and the ability to directly improve the bottom line."

Cameron thinks the survey's increased view of treasuries as profit centers is primarily attributable to treasury teams "working with businesses more and seeing the advice they give to the business directly affecting the bottom line." For example, she says, "treasury might be helping procurement with contract terms around any indexation for commodity price volatility, or with resetting prices with suppliers if the markets move during the year.

"In aggregate," she adds, "the survey results indicate that treasurers are seeking to be more strategic. Rather than staying siloed and tactical and operational in what they're doing, treasury teams are becoming more proactive within their businesses." They are increasingly taking central roles in merger and acquisition (M&A) decision-making, in understanding emerging-market risks, in repatriating funds out of restricted markets, and in improving management of working capital. "It seems like there has been an improvement, across the board, in the strategic focus of treasury," Cameron says.

Another example she offers is helping sales and marketing with pricing of goods and services globally. "A lot of tech companies price their services in dollars in different regions around the world," Cameron says. "Then they try to pass off that risk by having their foreign subsidiaries buy goods and services, such as local marketing, in U.S. dollars. But if you really drill down into those transactions, you'll see that the U.S. dollar prices the subsidiaries are paying vary with the exchange rate. So the local U.S. dollar spending is only masking, not mitigating, any currency volatility."

If the treasury team gets involved, she says, they might ask the procurement or sourcing team, "'Is this spend in this local market really a U.S. dollar cost, or is it a local currency cost? Because if it's a local currency cost, we're in a better position to hedge the foreign exchange risk than our local supplier is.' In other words, it's more efficient for the big tech company to pay in local currency and handle the conversions to and from dollars." Cameron adds that treasury teams in some companies have been involved in these processes for years, but many others are just starting to expand beyond their function's traditional purview.

Helping treasury teams along are several technologies that improve automation—thus reducing tedious manual workloads and supporting treasury's pivot to a more strategic focus. Most survey respondents place at least some degree of importance on visual analytics (93 percent of respondents), robotics (89 percent), big data (91 percent), machine learning (88 percent), and blockchain (77 percent). Unfortunately, however, fewer than 5 percent of respondents claim to be well-versed in most of these technologies.

"What concerns me about the survey," Cameron says, "is that as treasurers are becoming more strategic, they appear to be feeling less enabled by the technology that supports them. Treasury departments need to be well-versed in visualization and robotics and these other technologies in order to make the case for investment. If they don't improve their understanding of what these systems have to offer, then our survey two years from now will show people continuing to complain about their technology but not doing much about it."

She adds that the changes these technologies facilitate—and the move toward more involvement in corporate strategy—will be uncomfortable for some treasury teams. "This is a scary situation in many respects," Cameron says. "Over time, these technologies will change the way in which work is done, and will change some of the skill sets treasurers are looking for in new hires. You may need to start recruiting a couple of data scientists into the team, rather than additional cash analysts.

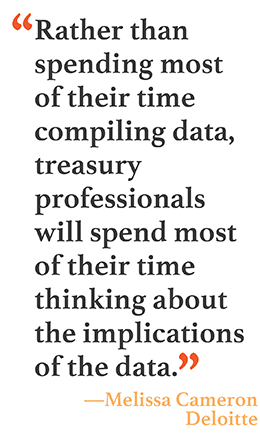

"Ultimately, though, this will take the robot out of the person. Rather than spending most of their time compiling data, treasury professionals will spend most of their time thinking about the implications of that data."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.