Today, global risk analysis company Verisk Maplecroft released the results of its latest Civil Unrest Index Projections. The outlook is not optimistic.

The firm identifies 37 countries that it expects to face major spikes in unrest during the second half of this year. Drivers of this dissension include the growing numbers of unemployed, underpaid, and underfed citizens in these jurisdictions. Covid-19 has routed economies around the world, and Verisk Maplecroft expects the slow and painful recovery to inflame the public's anger with their governments. This poses "a risk to domestic stability with few parallels in recent decades," the firm warns.

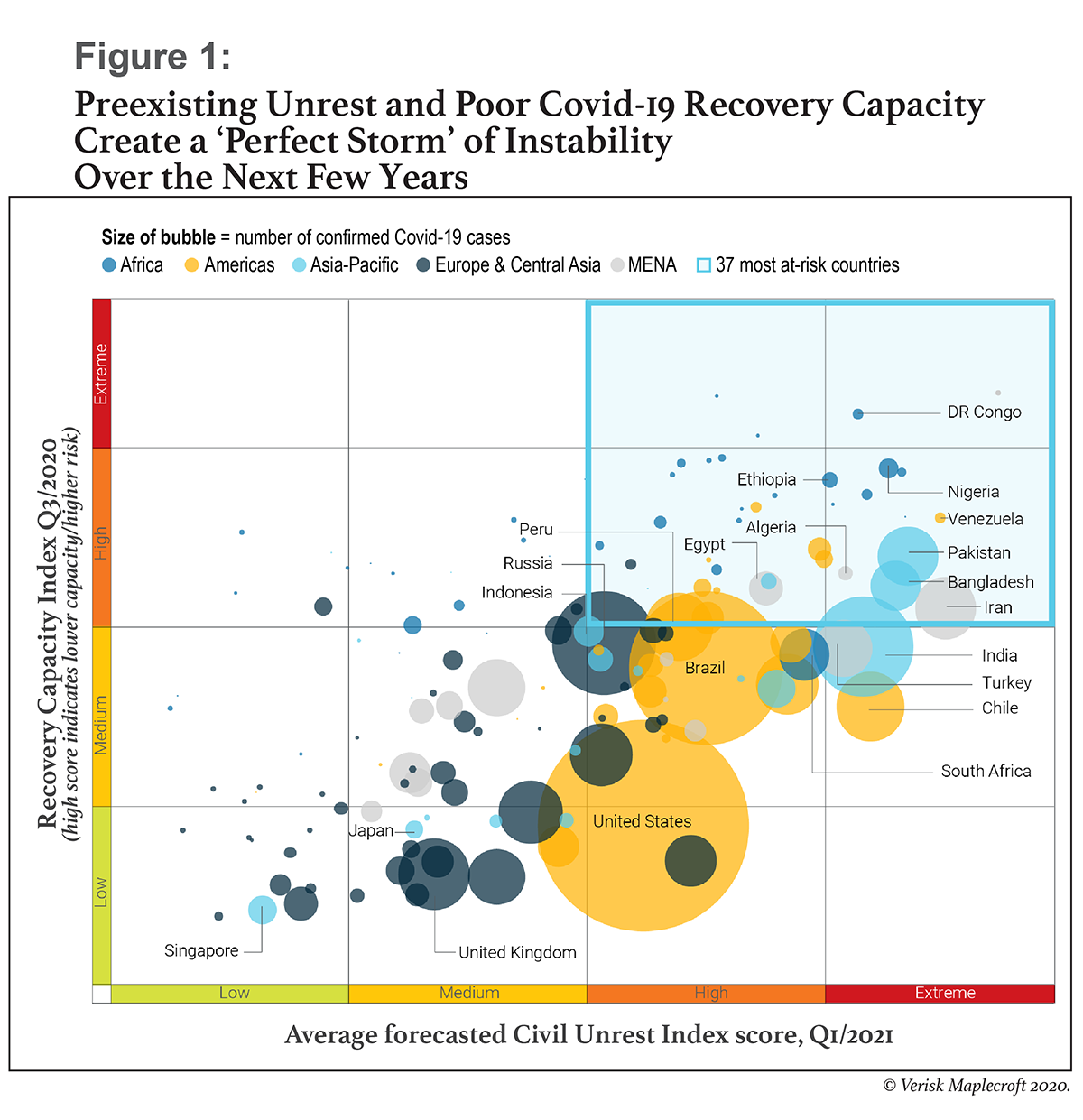

Most of the economies facing the highest risks are located in Africa and Latin America, although the United States is also at medium to high risk. (See Figure 1, below.) Unrest in emerging and frontier markets fell during spring 2020, presumably as a result of government lockdowns. However, protestors are now hitting the streets worldwide, speaking out about socioeconomic inequalities, civil and political rights, and government corruption. Nigeria, Iran, Bangladesh, Algeria, and Ethiopia are among the highest-risk countries, as they face a "perfect storm" of anger over both the pandemic economy and preexisting grievances.

"The total number of protests in frontier and emerging markets has almost rebounded to pre-pandemic levels," says Miha Hribernik, principal analyst with Verisk Maplecroft. "With many countries still in lockdown, and the full economic shock of the outbreak yet to be felt, we expect the number of protests to surge over the next two to three months."

Verisk Maplecroft combined data from its six-month Civil Unrest Index Projections and its Recovery Capacity Index, which measures a country's ability to bounce back from the economic devastation of the pandemic by assessing the strength of state institutions, physical and digital connectivity, economic dynamism, population sensitivity, and country-specific factors that could impede recovery (such as natural disasters or terrorism). The combined analysis of these two indices projects that 37 countries will experience both low levels of recovery capacity and high levels of civil unrest over the coming two quarters.

"Our base case from January—that 2020 will see a surge in protests and that the coming decade is set to be one of unprecedented unrest—still stands," says Hribernik. "But in the countries least prepared to bounce back from the pandemic, it now looks like a best-case scenario."

For nations in which grievances around political rights or structural problems have been festering for years, even a strong economic recovery may not eliminate the risk of civil unrest. As examples, Verisk Maplecroft cites India, which it ranks 21st most risky, and Hong Kong (28th). India, the firm says, is focused on tackling the explosion of coronavirus cases, so its recovery capacity is middle-of-the-road. However, persistent anger over the Citizenship Amendment Act is set to resurface, putting the country at high to extreme risk of civil unrest. Similarly, although Hong Kong quickly suppressed its initial Covid-19 outbreak, anti-government protests have resumed and will likely continue to foment unrest.

Verisk Maplecroft rates the United States the 48th riskiest country in the world. "The combination of Black Lives Matter protests, alongside mounting frustration over job losses and President Trump's weak pandemic response, means more unrest is inevitable," the report concludes.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.