The latest candidate to replace LIBOR is the $20 trillion U.S. Treasuries market.

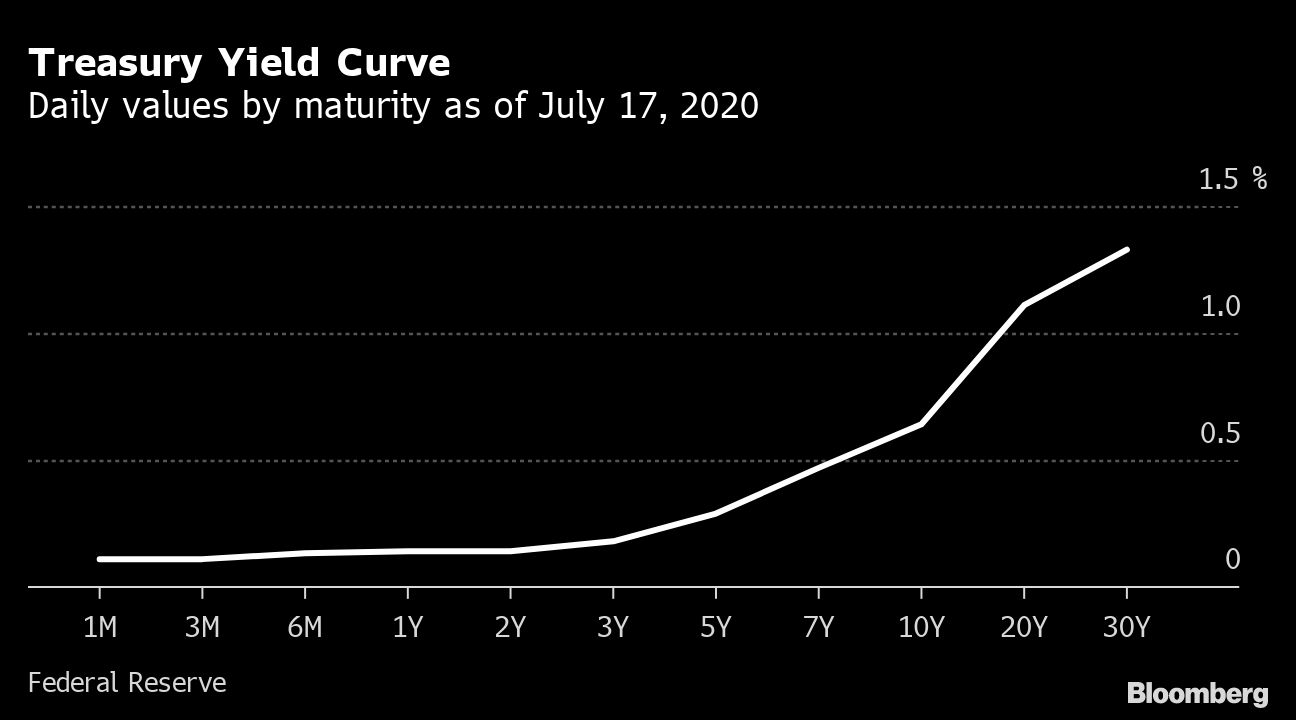

Tradeweb Markets Inc. and Intercontinental Exchange Inc. (ICE) are offering up an alternative in the form of a daily Treasury yield curve with 12 tenors ranging from one month to 30 years. The organizations started publishing the yield curve last week. The yields are based on transactions done over the course of the day on Tradeweb's institutional trading platform, among the biggest marketplaces for U.S. government debt.

Intercontinental Exchange says the rates "offer a number of potential benefits for market participants." It also touts the product as more consumer-friendly than the Secured Overnight Financing Rate (SOFR), the gauge that U.S. regulators have endorsed to replace LIBOR by the deadline at the end of next year.

A sequence of yields on Treasury securities "is an easier concept for many household borrowers to understand than benchmarks based upon repurchase rates or wholesale bank funding rates," Timothy Bowler, president of ICE Benchmark Administration, said. SOFR is based on overnight loans collateralized by Treasury repurchase agreements.

The Treasury yield curve, which the companies say will comply with principles for benchmark administration published in 2013 by the International Organization of Securities Commissions (IOSCO), "could be a viable alternative to U.S. dollar LIBOR" in applications including variable-rate mortgages and total return benchmarks for short-duration funds, said Bowler, who previously worked for the Treasury Department and Goldman Sachs Group Inc.

LIBOR's use as a benchmark dates from 1986 and was embedded in more than $350 trillion of financial contracts in 2017 when U.K. regulators announced measures intended to phase it out by 2021. IBA took over the administration of LIBOR from the British Bankers Association in 2014.

See also:

- Spike in LIBOR Offset Rate Cuts

- Is the Fed Undermining the Push to Kill LIBOR?

- Showdown in the LIBOR Corral

- LIBOR's Demise Will Up-end Derivatives

- 'Zombie LIBOR' Threatens Market's Complacent View

The transition to a successor has been under way for years and remains "of paramount importance," John Williams, the president of the Federal Reserve Bank of New York, said this week. A committee convened by the U.S. central bank picked SOFR—which is administered by the New York Fed—as its preferred alternative to LIBOR in 2017. The New York Fed this month said its SOFR index and averages are IOSCO-compliant.

Tradeweb and IBA say IOSCO compliance is one of several ways their new product is distinct from yields the Treasury Department publishes for its securities. The government's quotes are a snapshot based on prices provided by dealers, while the Tradeweb/IBA collaboration is based on transactions over the course of the day. The companies' yields go out to an additional third decimal place and will be published weekdays by 5 p.m. New York time.

Announcing the product on Thursday, they said they've been testing it for 18 months and are asking stakeholders for feedback by September 18 before finalizing the methodology.

Tradeweb and IBA last year collaborated on the introduction of daily closing prices for Treasury securities.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.