Companies shopping in the $237 billion U.S. commercial-insurance market are purchasing liability products more than any other type of coverage, a recent study shows.

In its latest sigma study, titled "Insuring Ever-Evolving Commercial Risks," Swiss Re notes that corporate insurance demand varies by company size and industry, but overall, premiums for liability coverages averaged $1.75 per every $1,000 in revenue for companies across nine industries in 2010, more than any other commercial coverage.

The services industry spent the most on liability — $4.15 spent on premiums per every $1000 in revenue. This finding supports Swiss Re's contention in the report that insurance demand in advanced-market economies is shifting toward liability coverages as services sectors expand at the expense of manufacturing.

Recommended For You

The transportation, communications and utilities industries placed behind the services industry, spending $3.79 of every $1,000 in revenue on liability insurance premiums.

Workers compensation was the second-most-purchased commercial insurance coverage, with the construction and services industries showing the most demand in 2010. The third- and fourth-most-popular commercial lines were property and commercial auto, while business owner's policies (BOP) saw the lowest demand.

As a business sector, construction spends the most on insurance relative to revenue, followed by transportation, communications, utilities and mining.

Swiss Re reports that construction companies operating in industrialized countries usually pay the most for insurance due to the many legal and insurance regulations to which they are subject. The lowest insurance-to-revenue ratios are seen in the financial services, trade and government sectors.

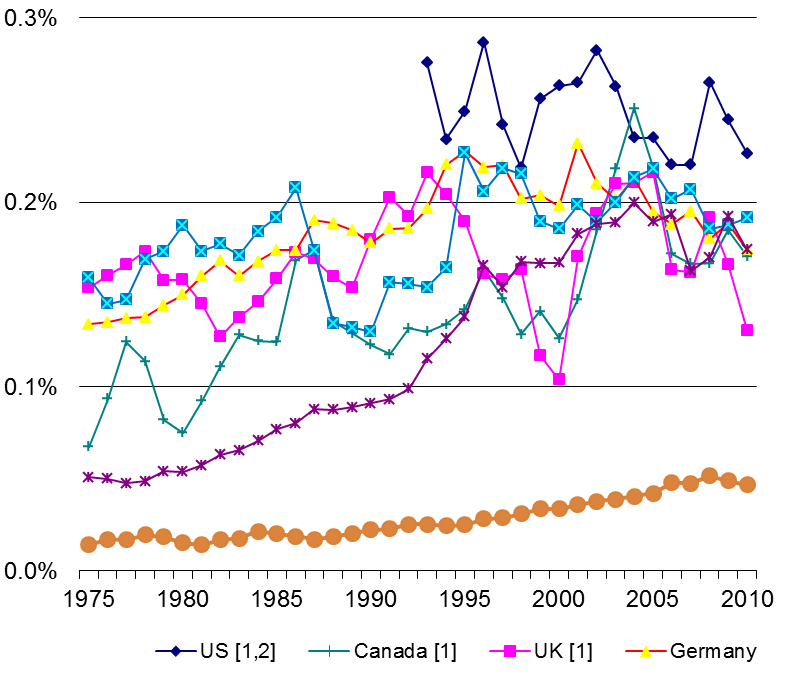

Source: Swiss Re Economic Research & Consulting

Swiss Re also analyzed demand based on company size, finding that large companies purchase higher limits than smaller companies, but spend less on insurance as a percentage of revenue: $3 per $1,000 in revenue in 2010 for large companies versus $7 per $1,000 for small companies.

Swiss Re says a contributing factor to the difference is that medium frequency and severity risks are often self-insured by large companies, which might dedicate an entire department to risk strategy, while small companies may have to outsource risk management to brokers or consultants.

Additionally, Swiss Re explains that large companies tend to pool risks, purchase large deductible programs or use alternative risk transfer tools (ART) such as captives and self-insured retentions. In fact, large companies spent almost as much for ARTs as for traditional insurance in 2010 — $48.5 billion against $52.3 billion in risk transfer mechanisms that year.

Small companies, says Swiss Re, are more reliant on fixed-cost programs and may organize insurance pools or establish mutual insurance companies such as risk retention groups (RRGs) to innovate affordable coverage solutions. These types of organizations spent $63.9 billion on traditional insurance in 2010 but under $1 billion dollars on ART's.

Both large and mid-sized corporations spent most of their insurance premiums on liability insurance. liability insurance followed by property.

Small businesses spent most of their insurance premiums on workers compensation, followed by liability. They were also virtually the only companies purchasing a significant amount of business owner's policies, spending about $14 billion on the line in 2010.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.