Federal Reserve Chairman Jerome Powell suggested that the U.S. central bank would push ahead with gradual interest-rate increases even as it remains on the lookout for threats to the financial system in the wake of the recent stock market rout.

“We are in the process of gradually normalizing both interest rate policy and our balance sheet,” he said Tuesday in the text of his ceremonial swearing-in speech in Washington, adding: “We will remain alert to any developing risks to financial stability.”

These were Powell's first public comments since financial markets last week suffered their most severe bout of volatility in years, partly on concern that rising wages might spur inflation and prod the Fed into faster rate hikes.

Recommended For You

While the new Fed chairman didn't specifically mention the steep fall in share prices, other central bank officials have played down its impact on the economy and the financial system.

Federal Reserve Bank of New York President William Dudley last week called the share shakeout “small potatoes,” while Cleveland Fed President Loretta Mester said on Tuesday that the turmoil hadn't affected her economic outlook or her support for further interest-rate hikes.

“If economic conditions evolve as expected, we'll need to make some further increases in interest rates this year and next year, at a pace similar to last year's,” when the Fed raised rates three times, she said in a speech in Dayton, Ohio.

In their last quarterly projection in December, Fed officials penciled in three rate hikes for this year, according to the median forecast in their so-called dot plot. They tacitly reiterated that view at their meeting January 30 to 31, when they said they expected “further gradual increases in the federal funds rate.”

Powell's comments on Tuesday “were consistent with the message” in January, said Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York. They're “in a process of raising rates and not close to the finish line.”

Investors see a quarter percentage point hike at the central bank's next policy-making meeting on March 20 to 21 as a virtual certainty, according to pricing in federal funds futures.

Powell said the Fed had made “great progress in moving much closer” to its goals of full employment and stable prices since he joined the central bank as a governor in 2012.

Unemployment is down to 4.1 percent, from 8.2 percent back then. Inflation, though, remains below the Fed's 2 percent target, standing at 1.7 percent in December.

“Today, the global economy is recovering strongly for the first time in a decade,” Powell said.

He said the Fed was moving to normalize monetary policy “with a view to extending the recovery and sustaining the pursuit of our objectives.”

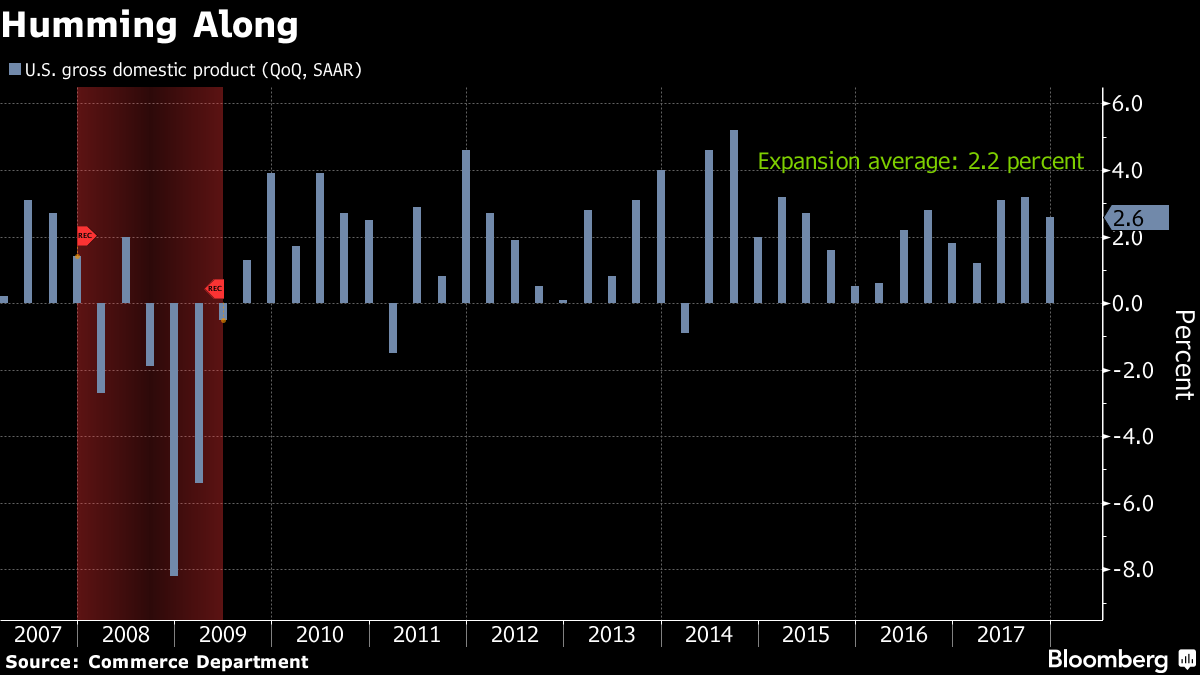

The 8-1/2-year-plus upswing is already the third longest on record, although it has also been the slowest in more than 65 years, averaging annual growth of just 2.2 percent.

Powell pledged to preserve the essential improvements made in financial regulation since the 2007-09 crisis while seeking to make sure the Fed's approach is as efficient as possible

“The financial system is incomparably stronger and safer, with much higher capital and liquidity, better risk management, and other improvements,” he said.

He also promised to “continue to pursue ways to improve transparency both in monetary policy and in regulation.”

Once revered for its policy-making prowess, the central bank has come in for increasing congressional criticism since the financial crisis, with some Republican lawmakers calling for stepped-up oversight of its monetary policy actions.

“We listen to feedback and give serious consideration to the possibility that we might be getting something wrong,” Powell said. “There is great value in having thoughtful, well-informed critics.”

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.