For European banks, it's a headache that just won't go away: the 944 billion euros (US$1.17 trillion) of non-performing loans that are weighing down their balance sheets.

Economists say the pile of past-due and delinquent debt makes it harder for banks to lend more money, hurting their earnings. European authorities are prodding lenders to sell or wind down non-performing credit, but they're split on how to tackle the issue, and some investors are disappointed by the pace of progress.

There are various ways of calculating soured loans. The European Central Bank (ECB) advises that non-performing asset indicators should be interpreted with caution because the definition of impaired assets and loss provision differ between countries. The data used below refers to domestic banking groups and stand-alone banks only, and excludes foreign subsidiaries and controlled branches.

“The data for the Czech banking sector consist of the banks that represent only 6 percent of credit extended by the banks operating in the Czech Republic,” the central bank said by email.

Here are five charts using the ECB data that help explain the non-performing loan issue and how banks are tackling it.

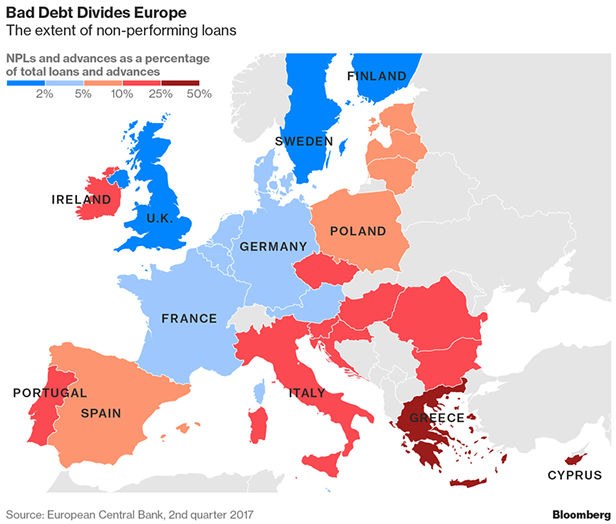

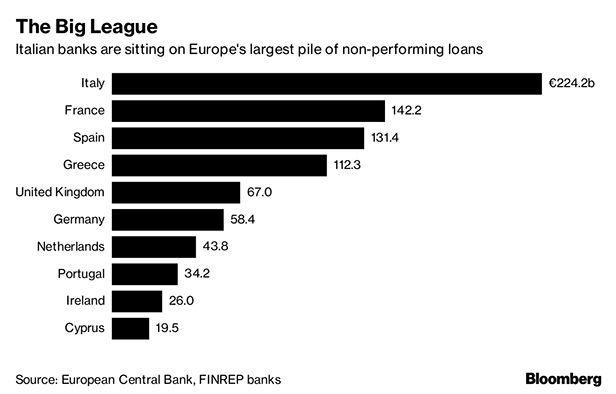

The problem is particularly acute in the countries that were hit hardest by the sovereign debt crisis. Greece, which has yet to exit its bailout program, tops the list of non-performing loans as a share of total credit, while Italy has the biggest pile of bad debt in absolute terms.

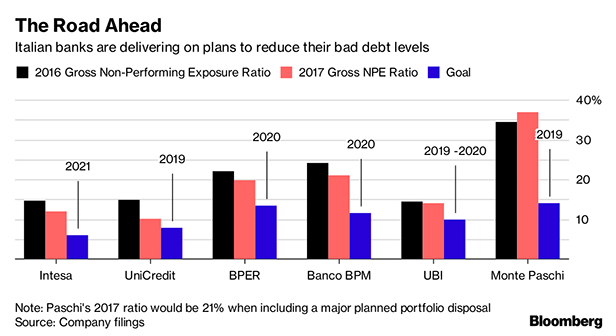

Italian banks have fixed goals for shrinking their bad credit levels by selling portfolios or winding down loans. Intesa Sanpaolo SpA, the country's biggest bank by market value, got a head start on its rivals two years ago and plans to accelerate the reduction of non-performing loans, CEO Carlo Messina said last month. He says other Italian banks “are doing the right job” and should make further progress this year.

Italy amassed its pile of non-performing loans during years of little or no economic growth. The problem is compounded by the country's legal system, where it takes lenders longer to liquidate collateral than in many other countries. Italy overhauled its bankruptcy rules in October to make them quicker and more efficient.

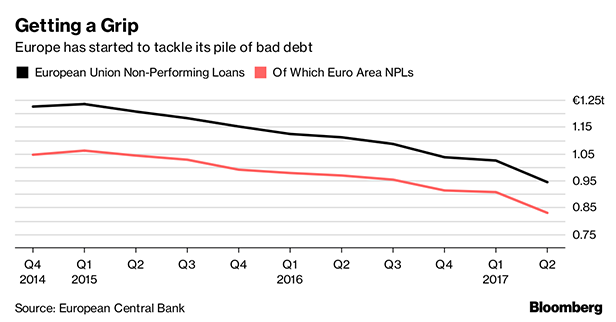

European banks overall have cut their non-performing loans by more than 280 billion euros since the end of 2014. The ECB, which supervises most of the bloc's big lenders, says bad debt is still “a major problem” which has to be addressed lenders while the economy performs well.

The flow of new bad loans is declining in Italy, but the level remains above that seen before the financial crisis. The Bank of Italy says an improvement in the country's real estate market is helping to reduce the risks for banks. According to the central bank's most recent financial-stability report, key vulnerability indicators for lenders should continue to decrease over the next few quarters.

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.