From Riyadh to Sydney, short-term funding markets worldwide are starting to feel the effects of soaring U.S. dollar LIBOR rates.

The surge in recent weeks in this key global short-term financing indicator may have a mostly technical explanation, meaning it's probably not flashing warning signals like it was during the credit crunch or the European sovereign debt crisis. Nonetheless, it's still making funding more costly for some borrowers outside the United States.

The three-month London interbank funding rate (LIBOR) rose to 2.27 percent Wednesday, the highest since 2008. The concern is that the LIBOR blowout may have more room to run, a prospect that borrowers and policymakers in various markets are just beginning to grapple with.

Recommended For You

“There has been sort of the perfect storm of factors tightening financial conditions,” said Russ Certo, head of rates at Brean Capital in New York. “Banks do have tremendous liquidity still, but it's at a higher price.”

The LIBOR increase is due in part to the deluge of Treasury-bill issuance since the U.S. debt ceiling was raised in February, which has helped drive bill rates to the highest since 2008. The U.S. tax overhaul is also coming into play, by spurring expectations that companies will park cash in commercial paper as part of repatriating money. And of course there's the fact that the Federal Reserve is tightening policy.

Whatever the explanation, the phenomenon is becoming a global one. Here's how rising U.S. dollar funding costs are flowing through to other regions:

Mideast Ripple

LIBOR's rise is complicating Saudi Arabia's efforts to stem the risk of capital flight as the Fed is poised to continue raising rates.

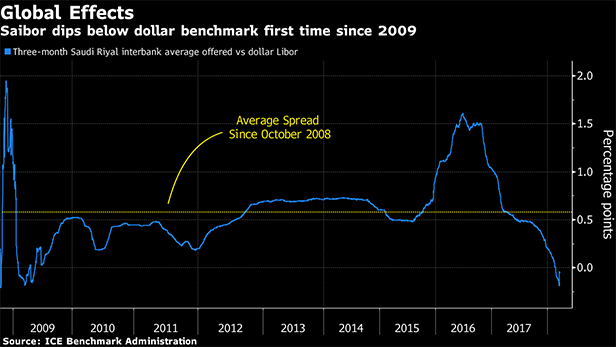

In February, Saudi Arabia's interbank offered rate, SAIBOR, fell below U.S. LIBOR for the first time since 2009. The kingdom's monetary authority raised rates last week ahead of an anticipated U.S. hike Wednesday, the first time the kingdom has changed the repo rate in almost a decade. The move lifted the key Saudi interbank rate closer to the LIBOR rate, making it less attractive for depositors to shift into dollars.

Since October 2008, SAIBOR has been about 60 basis points above LIBOR on average. On March 16, it was 19 basis points below, the most in a decade, an indication of ample liquidity in the domestic banking system.

Asia Impact

Rising LIBOR is also fueling uncertainty surrounding Hong Kong's peg to the U.S. dollar.

The benchmark is 117 basis points above Hong Kong's interbank offered rate, or HIBOR, the widest gap since 2008. The increase has pushed the local currency to the weak end of its band versus the dollar, spurring speculation the Hong Kong Monetary Authority will step in.

Indeed, a majority of analysts surveyed by Bloomberg said they expected the monetary authority to act.

Down Under Too

The leap in LIBOR is also being felt in Australia's financing markets.

It's made overseas borrowing more expensive for the country's banks, which could push up domestic issuance, TD strategist Prashant Newnaha said in a note last week. As a result, short-term funding costs for Australian banks are set for their biggest monthly increase since 2010.

Australia's banks, along with their global counterparts that tend to look to the U.S. for funding, are also dealing with the consequences of American tax legislation.

The overhaul offers U.S. companies incentives to repatriate money. In preparation, they're investing the funds in short commercial-paper (CP) tenors that resemble cash. That means less demand for three-month CP, pressuring those rates and LIBOR higher, and forcing foreign borrowers to turn to their home markets for funding.

For analysts, the key is whether rising LIBOR rates will fuel a funding crisis. One proxy of bank borrowing costs—the spread on LIBOR over a risk-free rate known as the overnight index swap (OIS)—has more than doubled since January.

“We usually don't see this kind of divergence in rates without some sort of credit issue,” said Margaret Kerins, head of fixed-income strategy at BMO Capital Markets Corp., referring to LIBOR's rise versus OIS. “At what point does all this become damaging and how far does it go? That is the issue.”

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.