The high-grade bond market has turned from borrower paradise to borrower … purgatory.

The high-grade bond market has turned from borrower paradise to borrower … purgatory.

Investors have forced investment grade-bond issuers in the United States to pony up more money to sell top-notch bonds over the past month. After paying little in so-called new issue concessions, borrowers are now regularly forking over a premium of more than 10 basis points as more investors become choosy about the debt they buy.

This is a major shift that has put buyers in the driver's seat after companies paid almost nothing to sell a massive amount of debt over the last two years.

Recommended For You

The new dynamic was created through the combination of a recent flood of bond sales to fund acquisitions, fewer foreign investors due to higher hedging costs, a rush of cash from abroad into the pockets of American corporations due to tax reform, and the Federal Reserve raising rates. Borrowers are now trying to figure out whether the shift is a passing trend or the new normal.

“Tighter monetary policy, higher cash rates, and the U.S. government's need to finance an annual deficit are pushing investors into cash, U.S. Treasuries, and non-USD bonds,” Wells Fargo & Co. head of credit strategy George Bory wrote in a recent note.

Last year, there was a wave of investment-grade bond refinancing as companies took advantage of the lowest borrowing costs in a generation. Apple Inc. was a standout, selling $30 billion of debt through five separate sales. But it didn't matter who the issuer was. Order books grew to at least three times the size of the deal, while the premium paid to issue new debt was almost nothing or even negative.

Fast forward to now. All that borrowing is beginning to creep up on companies. Supply is down 20 percent from a year ago, as tax reform and higher interest rates have weighed on the primary market. Some issuers are paying whopping double-digit premiums as deals aren't as oversubscribed. Financial research firm CreditSights Inc. said it doesn't expect Apple to bring a bond deal this year following last year's deluge.

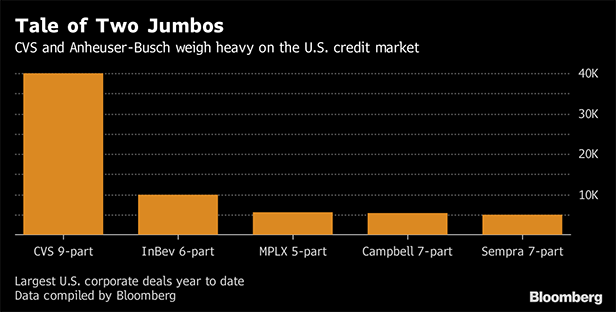

While it would seem that a drop in supply would translate into cheaper borrowing costs, a recent flood of large high-grade deals and fewer buyers from abroad ate away at borrowers' ability to negotiate better terms. CVS Health Corp.'s $40 billion deal earlier this month to fund its acquisition of Aetna Inc. is an example of a big sale that soaked up investors' appetite and dampened demand across the market.

“Spreads in U.S. investment-grade bonds may not recover until after a backlog of M&A and general corporate financing works through the system,” Goldman Sachs Group Inc. credit analyst Amanda Lynam wrote in a note.

The reduction in foreign investors has also made it more costly to sell debt. Lynam points to weaker Treasury International Capital flows data that suggested the appetite abroad for U.S. corporate bonds has shrunk due to the rising cost of hedging currency risk, which cuts away at the yield for investors outside of America.

While foreign investors may remain absent for the foreseeable future, Goldman said, the path for issuers may become less difficult as the trends of big deals and repatriation begin to fade.

But in the meantime, borrowers will have to wait and see.

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.