If Winston Churchill's observation that “the optimist sees the opportunity in every difficulty” still holds, then upbeat treasury leaders possess especially sharp vision these days.

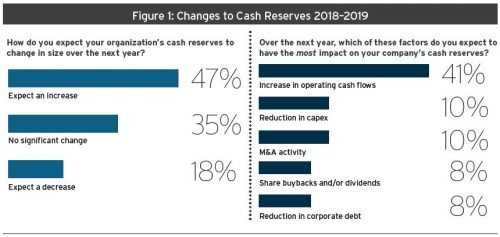

Corporate treasury functions are contending with a raft of regulatory demands and technological disruptions at the same time the broader economy is characterized by rising interest rates, Brexit, and other macroeconomic disturbances. Despite formidable volatility, most treasury executives who participated in the “2018 Cash Management Survey” from Treasury & Risk see their organization's cash reserves holding steady or increasing during the next 12 months. (See Figure 1, below.) Nearly 30 percent of respondents expect cash reserves to rise by more than 10 percent.

Those projections are notably higher than the cash reserve changes that survey respondents say occurred within their companies during the past year: Only 15 percent of organizations increased cash reserves by more than 10 percent over the past 12 months. “These responses demonstrate that companies are very optimistic about the economy and about their prospects for a higher level of cash,” says Michael Berkowitz, Citi's North America and global product head of liquidity management services.

The survey was completed in September by treasury executives across all industries. Thirty-three percent of responding companies post annual revenues of less than $100 million; 40 percent earn $100 million to $10 billion; and 27 percent exceed $10 billion.

Projected boosts to operating cash flows mark the most influential factor on cash reserve changes in the coming year, followed by reductions in capital expenditures and merger-and-acquisition (M&A) activity. The ongoing impact of the U.S. Tax Cuts and Jobs Act (TCJA) remains a formidable factor, cited as having an impact by 22 percent of respondents who expect cash stockpiles to grow. Treasury functions, spurred on by rising interest rates, continue to transition from a post-crisis defensive crouch to an aggressive focus on maximizing both liquidity and yield.

Executing these two objectives will require an optimistic mindset given the combination of challenges impeding cash management activities. The survey results show that treasury leaders plan to work through uncertainty by re-ordering cash management priorities, consolidating the number of banks they use for cash management, and working with their banking partners to optimize new treasury technologies.

Regulatory and Technological Challenges

It is important to consider this year's survey results in light of several significant forces. From a regulatory standpoint, Basel III requirements continue to drive revisions to multinationals' liquidity strategies. On the macroeconomic front, Brexit is causing many treasury functions to reconsider where they issue European payments and to rethink cash pooling structures. The U.S. Federal Reserve's draining of liquidity from the financial system is elevating short-term interest rates and reversing quantitative easing, which is nudging longer-term rates higher as well. This trajectory suggests that there will be less cash in the banking system in the near future, which should challenge survey respondents' rosy expectations regarding their own cash reserves.

An extended period of low interest rates heaped an historic amount of debt on corporate balance sheets. Now “corporate treasury organizations are likely rethinking their long-term debt strategies as interest rates rise,” notes Deloitte Risk and Financial Advisory Partner Carina Ruiz-Singh, who leads Deloitte & Touche LLP's treasury transformation practice.

Widespread technology advancements and related digital transformation initiatives promise attractive long-term benefits—including faster global payments and new payment models—but also give rise to shorter-term disruptions and risks. Artificial intelligence, robotic process automation, blockchain applications, and other advanced technologies enable “treasurers in multinational corporations to work more efficiently while also gaining a better view into where cash around the world sits and the possibilities for it,” Ruiz-Singh points out. Yet treasury's growing use of data and data-sharing gives rise to new cybersecurity and fraud risks, as well as compliance concerns. The “vulnerabilities presented by changing payments methods, more aggressive cyber risks, and managing through evolving and rapid technological changes challenge corporate treasuries to rethink their role in cash governance,” Ruiz-Singh adds.

Looking Back: Tax Reform Raises Reserves

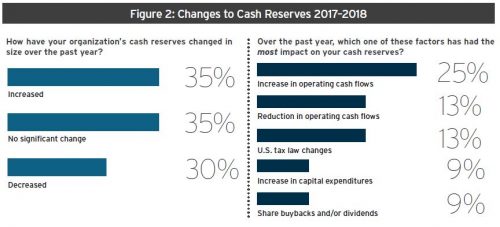

U.S. tax reform has affected corporate treasury's activities while increasing the need for close collaboration with the tax function. Survey respondents identified U.S. tax law changes as the factor having the second largest impact on cash reserves behind increases in operating cash flows.

The TCJA forced corporate treasurers, CFOs, and chief tax executives to evaluate how much cash to repatriate to the U.S. and how to reorganize different legal entities to optimize tax exposure and cash reserves. Treasurers and their executive colleagues also have been busy deciding where to invest tax-cut savings. A recent Korn Ferry International survey indicates that increasing capital investments and cash reserves are the two highest priorities. “Changes in tax code can impact cash management, as organizations rethink their internal banking structures, decide whether or not to pay down debt, and work to get their treasury and tax professionals working more closely together,” Ruiz-Singh points out.

During the past two years, other regulatory changes and interest rate hikes have spurred organizations to make key changes to cash and short-term investment policies, including adding new asset classes (cited by 19 percent of respondents), eliminating prime money funds as a cash investment option (17 percent), increasing enforcement of the corporate investment policy (17 percent), shortening allowable maximum maturities (11 percent), and modifying money fund language to reflect prime funds' floating NAVs (9 percent).

In late 2016, the U.S. Securities & Exchange Commission's (SEC's) “floating NAV” rule required many treasury functions to adjust to a slightly-less-stable net asset value (NAV) for prime money funds. Similar, though less stringent, money-market fund reforms take effect in the European Union in January 2019. These changes help explain why 9 percent of survey respondents modified the verbiage in their corporate investment policy to reflect prime funds' floating NAV, and why 17 percent of treasury functions eliminated prime money market funds as a cash investment option.

Other changes to corporate investment policies, including adding new asset classes and ratcheting up enforcement of the rules, reflect responses to the changing interest rate environment. Companies that moved away from prime money market funds obviously needed to evaluate bank deposits, treasuries, government money market funds, or other alternative assets. As interest rates climb, Berkowitz notes, “scrutinizing your investment portfolio becomes all the more important due to the larger potential yield you're sacrificing by not managing it efficiently with the best possible investment options.”

Looking Ahead, for Yield

In cash and short-term investment decisions, treasury functions generally place the highest priority on safeguarding principal. Once they're comfortable that their investment options are acceptably stable, their attention turns to other rungs on their hierarchy of cash management needs—specifically, maximizing liquidity and maximizing yield.

That's the trend we're seeing now. Since the financial crisis, corporate treasury teams have invested substantial effort in safeguarding principal through such actions as process improvements and counterparty risk reviews. This work has paid off, so now, as interest rates rise, many treasury functions are adjusting their cash-management objectives. Survey respondents prioritize their goals for cash and short-term investments as follows:

- Maximize liquidity available immediately

- Maximize yield as interest rates rise

- Eliminate any chance of lost value in principal (e.g., from floating NAV)

- Minimize currency impact on cash earned abroad

- Minimize counterparty credit risk

- Understand and mitigate impact of geopolitical uncertainty.

Keeping Cash Abroad for Now

As treasury groups execute on these priorities, they are not planning to repatriate a lot of funds. Among the 59 percent of respondents whose companies have cash or short-term investments overseas, three-quarters (76 percent) indicated that the proportion they hold abroad will not change significantly over the next year. Among those that will make changes, 12 percent expect to make a small reduction and 10 percent a significant reduction in the proportion held abroad.

Given the potentially messy Brexit divorce and a looming EU tax overhaul, among other factors, treasury functions with short-term investments in Europe and elsewhere overseas should remain on their toes. “High volatility in the foreign exchange markets continues to challenge corporate treasury organizations,” Ruiz-Singh reports. “The ability to pull insightful foreign exchange exposure data easily and with accuracy appears to have become an increasing priority.”

Overall, survey respondents do not expect U.S. tax reform to be a leading factor in determining the size or location of their cash reserves in the coming year; only 4 percent selected the TCJA as the factor having the most impact (among 11 options). However, these treasury professionals may want to reconsider. “Based on our discussions with clients,” Berkowitz says, “we think that the majority of cash repatriation is yet to come.”

Fewer, but Deeper, Partnerships

Another cash management priority for corporate treasury teams is continuing to improve banking relationships while deriving more value from them. “Global and regional corporates have a set of key criteria for selecting their partner for cash management services and developing their relationship,” asserts Capgemini Payments and World Payments Report Leader Christophe Vergne. “They first need trust. They expect from their partner a strong commitment to the cash management service line and to the relationship with their company.”

These expectations are intensifying as macroeconomic conditions continue to swirl, regulators demand more—and much more detailed—information, and internal processes become more complex. Survey respondents indicate that they want their banking partners to introduce more simplicity and transparency to their relationships.

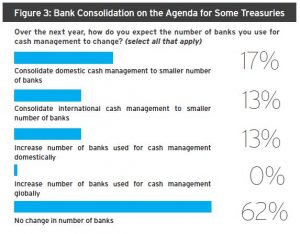

One step toward greater simplicity involves consolidation. While most survey respondents (62 percent) plan to hold steady their current number of banking partners, 17 percent expect to consolidate to a smaller number of banks for their domestic cash management and 13 percent plan to consolidate their international cash management banks. (See Figure 3.) Some respondents do plan to increase the number of banks they use for domestic cash management (13 percent), but none of the survey respondents expects their function to increase its number of international banking partners.

The nature of corporate banking relationships is also changing, according to those on both sides of the partnership. Treasury leaders who responded to the survey identified “getting technology to work properly” as their top focus in their cash management banking relationships, cited by nearly half of respondents (47 percent). This is not surprising, given the significant changes most treasury functions have made to internal treasury systems as well as many banks' embrace of digital transformation and advanced technology designed to improve user experience.

“It's our goal to simplify treasury processes for our clients,” Berkowitz says. “That means ensuring that our technology works well with their proprietary and third-party technology. Our goal is to make their experience with our systems as consistent and convenient as possible.”

Part of that convenience, survey respondents also indicated, includes linking treasury processes and supporting technology to broader finance initiatives, such as those involving accounts payable and accounts receivable.

The price companies pay for cash management services largely held steady or increased modestly during the past year: Sixty-five percent of respondents reported no significant change in price, 18 percent said costs increased by less than 10 percent, and 12 percent reported a price increase of greater than 10 percent.

So long as those price increases reflect offerings that equip treasury leaders with the transparency necessary to see the available opportunities around them, treasury functions appear likely to accept them. After all, as more regulatory and macroeconomic disruptions unfold, all treasury functions will need to avoid the pessimist's tendency to see only the difficulty in every opportunity.

Also from the October 2018 Special Report

SPONSORED STATEMENT: Diversity and Client Focus: A Prescription for Innovation

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.