Federal Reserve policymakers lowered their main interest rate for a second time this year while splitting over the need for further easing, caught between uncertainty over trade and global growth and a domestic economy that's holding up well.

The benchmark rate was lowered by a quarter percentage point, to a range of 1.75 percent to 2 percent, "in light of the implications of global developments for the economic outlook as well as muted inflation pressures,'' the Federal Open Market Committee (FOMC) said in a statement on Wednesday in Washington. It continued to characterize the U.S. labor market as "strong" with "solid" job gains.

Treasuries held on to gains, the dollar rallied, and U.S. stocks extended losses after the Fed's announcement. The decision didn't alter expectations among futures traders for another 25 basis point (bps) cut this year. Chairman Jerome Powell has been under relentless public pressure from President Donald Trump to slash rates.

"Although household spending has been rising at a strong pace, business fixed investment and exports have weakened,'' the FOMC said. Officials maintained their pledge to "act as appropriate to sustain the expansion."

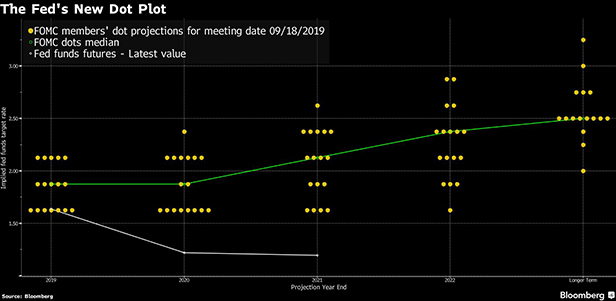

Five officials wanted to keep rates unchanged, while five saw a quarter point as appropriate this year and seven wanted a half point.

The Fed Board also took a separate step to calm this week's strains in money markets and avert harm to the economy, lowering the interest rate on excess reserves to 1.8 percent. Earlier Wednesday, the Fed injected $75 billion of liquidity to ease a crunch, and key rates pulled back from elevated levels.

Global Risk

Powell is trying to sustain the expansion despite slowing global growth that's been chilled by uncertainty over U.S. trade policy, fanning fears of recession. Manufacturing has been hit hard, particularly in Germany, which prompted the European Central Bank (ECB) to ease policy last week.

While the chairman has pointed to global risks, Trump blames the Fed: "Jay Powell & the Fed don't have a clue,'' he said on September 16.

Kansas City Fed chief Esther George and Boston's Eric Rosengren dissented against the reduction, as they did in July, preferring to keep rates unchanged. There was a new dissent by James Bullard of St. Louis, who preferred a half-point cut.

Powell's committee is split between those who don't think cuts are needed because domestic spending is solid and those worried by global weakness and inflation running persistently under their 2 percent goal.

Fed officials also released new quarterly forecasts:

- The median estimate saw the benchmark rate hold steady after today's move, at 1.9 percent, and remain there until the end of 2020, then rise to 2.1 percent in 2021 and 2.4 percent in 2022. That's just under the Fed's longer-run "neutral'' federal funds rate estimate, which was unchanged at 2.5 percent.

- The unemployment rate was forecast to end this year at about 3.7 percent, up a tenth from June, and finish 2020 at that level. The longer-run estimated jobless rate remained at 4.2 percent.

- Participants continued to forecast that they wouldn't reach their 2 percent inflation goal until 2021.

The Fed's back-to-back rate cuts reverse the tightening of last year and follow a wave of easing this year by other central banks. In addition to the ECB, some analysts expect the Bank of Japan to act at its meeting Thursday.

U.S. central bankers, who added the reference to exports, worry that uncertainty over trade is denting investment and could slow hiring. Private-sector job growth has slowed from last year.

At the same time, consumption—which accounts for most of the economy—appears strong, with retail sales rising 0.4 percent in August and sentiment indicators relatively solid. Financial conditions have remained easy since the July meeting, although the dollar has resumed gains against major currencies.

–With assistance from Katherine Greifeld and Nancy Moran.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.