Photographer: Wei Leng Tay/Bloomberg

Photographer: Wei Leng Tay/Bloomberg

When Credit Agricole SA and HSBC Holdings Plc issued a payment guarantee for a US$76.5 million fuel purchase from a Singapore trader in March, they unwittingly became the latest victims in a series of trade finance scandals that have led to more than $9 billion in potential losses for global lenders.

At the same time that Hin Leong Trading Pte. was pledging the fuel to back the loan, it allegedly agreed to sell the same cargo to another trader, who sought letters of credit from three banks including Credit Agricole.

This line of credit merry-go-round was among many allegedly fraudulent tools used by Hin Leong, one of Singapore's biggest oil traders before its spectacular collapse in April that left 23 banks on the hook for $3.5 billion, according to a report from court-appointed managers.

For banks financing the opaque world of commodities trading in Singapore, Hin Leong isn't an isolated case. The trading hub has seen a clutch of failures in the past year with lenders struggling to reclaim loans, alleging they were tricked by forged documents and by traders pledging cargoes to multiple banks. The two latest lawsuits show lenders, including HSBC and CIMB of Malaysia, exposed to about $640 million in potential losses.

"It's tumbling down like a house of cards—everybody is caught in the whirlwind," said Robson Lee, a corporate finance law partner at Gibson, Dunn & Crutcher LLP's Singapore office.

In a June 25 statement, Hin Leong founder Lim Oon Kuin said he was unfit to respond to the allegations in the report from the judicial managers. HSBC and Credit Agricole declined to comment.

Rather than flee the $18 trillion trade finance business, most banks are now taking steps to fight back. Singapore lenders are considering a central database to track collateral, according to a person familiar with the matter, while banks including ABN Amro Bank NV are stepping up vigilance. ING Groep NV and HSBC, two of the biggest players in the space, are turning to technology such as blockchain to limit fraud.

Trade Finance Fraud on a "Massive Scale"

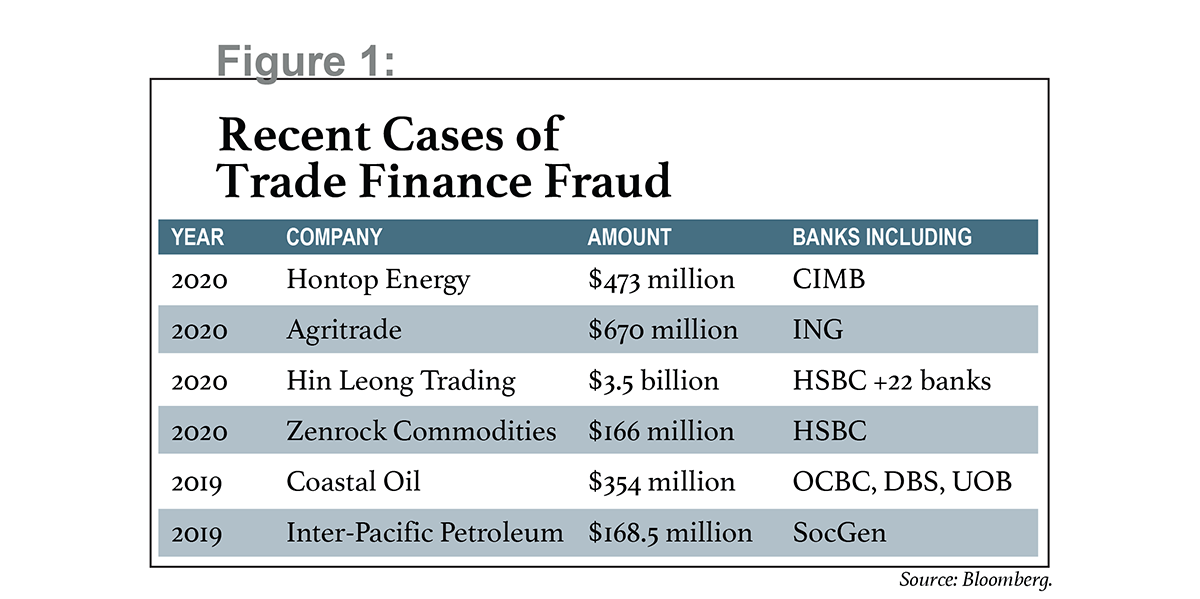

Banks' losses are mounting; Hin Leong is just the latest case of trade finance gone awry:

- ING accused Agritrade International Pte. in a lawsuit of "overlapping" shipping lists to get financing from several banks for the same cargo. About 18 banks face combined losses of $670 million.

- HSBC accused Zenrock Commodities Trading Pte. of carrying out "highly dishonest transactions" by using the same cargo for various loans. Banks are owed $166 million.

- CIMB Group Holdings Bhd said in a filing last week that Hontop Energy conducted "suspicious" oil deals. The trader owes $473 million.

Hontop, Zenrock, and Agritrade didn't return calls seeking comment.

Banks and other creditors face about $9.26 billion in potential losses from these and other failures over the past six years, all of them involving some form of alleged fraud, forgery, multiple cargo pledges, or questionable accounting, based on a Bloomberg News tally.

HSBC reported a $700 million increase in expected credit losses in April at its commercial banking division in Asia, primarily linked to Singapore. Standard Chartered Plc set aside $956 million against potential losses, partly due to the coronavirus pandemic and defaults by commodity traders. At ABN Amro, two client cases accounted for 460 million euros ($521 million) in provisions, including one tied to a "potential fraud case in Singapore."

Both banks are owed money by Hin Leong, whose financing scheme was among the biggest and most elaborate of all, a new report shows.

Some 60 letters of credit amounting to $1.5 billion were used to finance cargo that either didn't exist or was pledged to multiple buyers, according to an investigation by PricewaterhouseCoopers LLP, the court-appointed managers. In all, 273 letters of credit were spread among 23 banks. The banks' chances of recovery are low, as assets are worth 7 percent of liabilities.

"The company fabricated documents on a massive scale," PwC wrote in the June report, adding that the company's transgressions were routine and pervasive, misleading banks into extending credit.

In the world of trade finance, exporters and importers rely on credit lines to protect themselves against risks such as currency fluctuations, non-payment, and political instability. When it works, the short-term financing provides a relatively safe way for banks to generate a quick profit, as the lending covers sea voyages lasting just a few weeks.

Underlying Structural Problems

The financing doesn't work when the same barrels of oil or other commodities are used to get financing from multiple lenders, or when the cargo used to back the loans doesn't exist.

"Double financing is 100 percent illegal because a borrower is wrongly representing to different banks that it has security over the same goods," said Baldev Bhinder, a commodities specialist and managing director of BlackStone & Gold Llc, a Singapore law firm. "But banks have challenges in onboarding a live transaction quickly."

One of the reasons so many firms have duped the banks is there is little transparency in the trading process, said Kelvin Tan, a former deputy director at the Monetary Authority of Singapore, the city-state's central bank. As a result, banks can't determine whether the oil backing a loan is being pledged to another lender at the same time.

"The reason double, or multiple, pledging is a common problem in commodity trade finance is because there is no central database of such collateral," said Tan, chief investment officer of GTR Ventures, a trade finance technology firm. "This blow-up is exposing a structural flaw amongst not only banks, but also the ecosystem."

Banks have also suffered from old-school documentation. Transaction documents can run into the hundreds of pages, making copies and forgeries easier.

"The nature of this business means it's almost impossible for the banks to verify whether the goods pledged to them belong to them or if it's even there," said John Khaw, co-founder of Lucidity, a fintech startup that focuses on trade finance technology.

The banks also have to understand the risks of this sector, said Bhinder.

Margins on trade finance can be razor thin, as low as 0.25 percent, so lenders put a premium on volume. Staff turnover is also high, meaning bankers signing off on financing often lack expertise, said Clara Hang, former head of trade finance at Singapore's Oversea-Chinese Banking Corp. As a result, big borrowers like Hin Leong, with revenue of $20 billion last year, face less scrutiny, she said. "They place too much trust in the company," said Hang, founder of trade finance start-up eFundsme Global Pte.

In the wake of all these scandals, a few banks have eased up on trade finance. Societe Generale halted fresh funding to oil trading firms in Asia, while ABN Amro now considers the sector high-risk.

"Unfortunately, fraud tends to emerge in times of stress," ABN chief risk officer Tanja Cuppen said on a recent conference call. "We have taken lessons from these cases and have taken measures to prevent this from happening again."

Traders of everything from zinc to oil and rubber are feeling the pinch as banks heighten scrutiny. Several firms interviewed have said their bankers were pulling back from short-term financing or asking for more secured collateral. Financing costs have jumped, and in some cases the banks are refusing to issue letters of credit, according to the traders, who asked not to be identified because they're not authorized to speak publicly.

Even with the failures, most banks are sticking with the sector, betting that tighter controls, increased transparency, and new technology will help avoid losses in an otherwise lucrative business.

Lenders in Singapore set up a working group to raise standards for trade finance, according to a statement last week. One of the measures being considered is the central registry for cargo, according to the person familiar with the plans who declined to be identified as the matter is private.

DBS Moves to Digitize Trade Finance

DBS, Southeast Asia's largest bank, is eliminating manual workflows and has digitized key trade financing services including letters of credit, import bills, and shipping guarantees, according to John Laurens, head of global transaction services, in a presentation Monday to reporters in Hong Kong.

The bank has adopted blockchain technology for trade finance, including a dedicated platform for Chinese corporate clients that offers almost-instant verification of suppliers' credentials, Laurens said. The platform is integrated with various Chinese government databases that can validate and verify the authenticity of the transactions by suppliers.

Citigroup, which runs $4 trillion in daily trade flows, is using artificial intelligence to review transactions and documentation, said Kanika Thakur, head of Asia-Pacific trade finance.

See also:

- A Crypto Primer for Corporate Treasurers

- Does HSBC Deal Show Blockchain Is Viable for Trade Finance?

- Blockchain Experiment Could Change Trade Finance

- The Evolution of Supply Chain Finance

- Bank Backing for Open Account Trade Payments

DBS joined ING, HSBC, and several other banks in a new Singapore-based blockchain network known as Contour. The group claims the network, replacing a 400-year-old system of paper transactions, can cut the processing time for letters of credit to 24 hours, from as long as 10 days.

"The delays and archaic processes that have marred the trade finance sector can no longer happen, and effective solutions are vital to keeping the sector alive," Contour CEO Carl Wegner said in a statement.

For ING CEO Steven van Rijswijk, whose predecessor banks have been financing shipping since the 18th century, there will always be a few deals that falter.

"In that case, you will leave with a loss, but in and of itself, that's not a reason now to leave the trading commodity space," he said.

—With assistance from Ruben Munsterman and Joyce Koh.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.