Alphabet Inc. sold $5.75 billion worth of bonds with rock-bottom yields in the largest corporate bond sale dedicated to environmental, social, and governance (ESG) purposes.

The parent company of Google is looking to fund organizations that support Black entrepreneurs, small and midsize businesses impacted by Covid-19, as well as affordable housing, among other eligible proceeds listed in bond documents seen by Bloomberg. The borrowings can also be used to finance clean energy projects and green buildings.

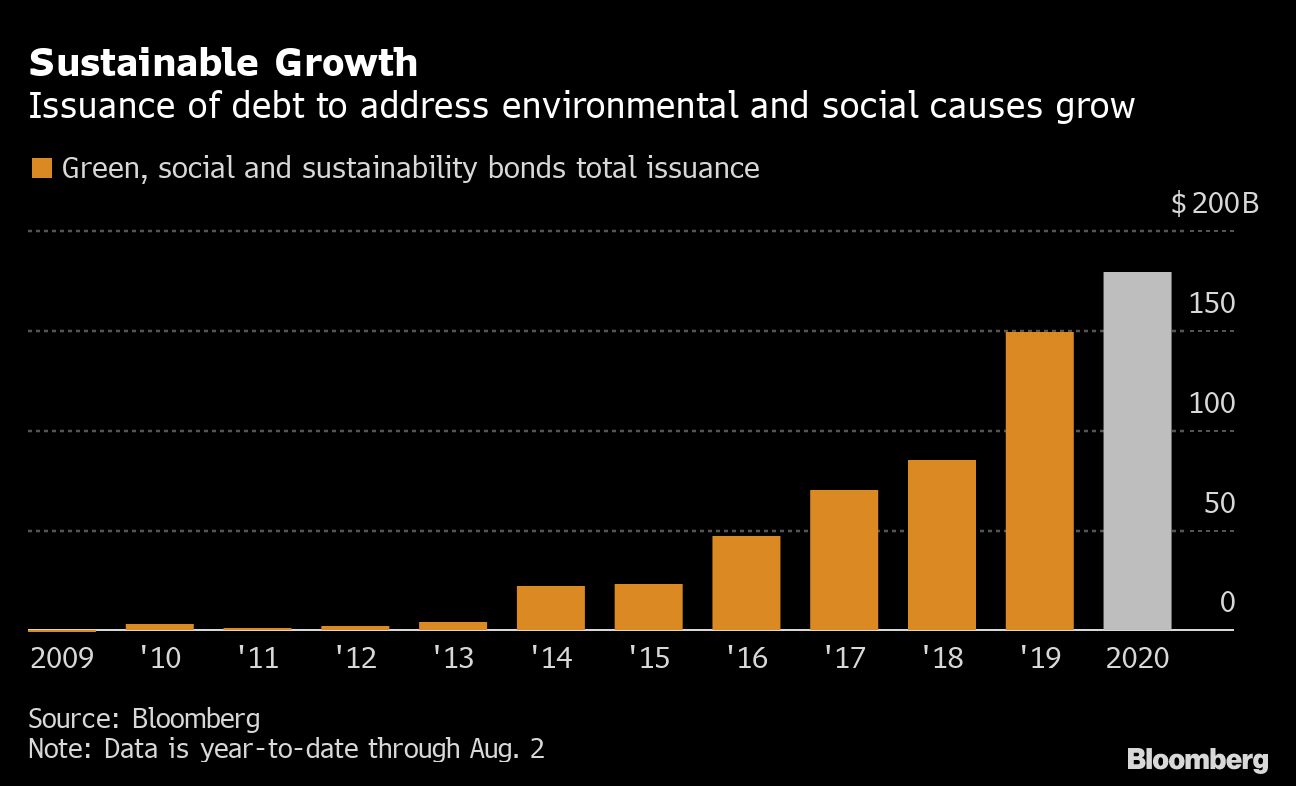

The bond sale comes amid a surge in similar offerings geared toward ESG efforts, with social bonds driving much of the increase due to the pandemic. Those offerings jumped 376 percent in the first half of 2020, compared with the same period last year, according to a report by BloombergNEF.

Recommended For You

"Going forward, we can expect to see more sustainability deals from tech companies given the continuing shift to a digital economy and their ability to influence how consumers spend money," said Stephen Liberatore, head of the responsible fixed-income strategy team at Nuveen.

Alphabet sold $10 billion of bonds in total, with other proceeds to fund general corporate purposes. It set record-low yields on the seven-year portion, at 0.8 percent, and with 40-year debt, at 2.25 percent, besting levels set by Amazon.com Inc. in June. Alphabet's new 10-year bonds will yield 1.1 percent, as will similarly-dated debt from industrial gas company Praxair Inc., also issued on Monday.

Investors had placed more than $38 billion in orders for the sale at the peak, according to a person with knowledge of the matter. The company, which last tapped the bond market four years ago, was said to initially target a deal size of around $7 billion, the person said, asking not to be identified since the details are private.

Google has prioritized supporting the Black community, recently announcing a $175 million "economic opportunity package" to invest in Black-led venture capital firms and startups, training for Black job seekers, and grants for small businesses. It also said it will hire more Black workers in senior roles and establish internal anti-racism programs for all employees, according to a June blog post.

Like other tech companies, Google has struggled to diversify its staff and top ranks—just 2.6 percent of its U.S. leadership is Black, according to its latest diversity report. That's unchanged from a year ago.

JPMorgan Chase & Co., Goldman Sachs Group Inc., and Morgan Stanley were lead managers on the bond sale, the person said. Diverse underwriters like Blaylock Van LLC, a minority-owned investment bank, and Drexel Hamilton, which is owned and operated by disabled veterans, were among the deal's co-managers.

In addition to the sustainability-linked proceeds, the bond sale will also support green projects. Google has been expanding its use of sustainable energy, touting its carbon-neutral status for over a decade. It's one of the world's largest corporate buyers of renewable power.

Supporting such efforts can pay off for investors, too, BlackRock Inc. said in a report Monday.

"We believe the adoption of sustainable investing is a tectonic shift that will carry a return advantage for years to come—and the coronavirus shock seems to be accelerating this shift," BlackRock Investment Institute strategists led by Mike Pyle said in the report.

—With assistance from Mark Bergen and Caleb Mutua.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.