Companies that took advantage of federal pandemic-relief efforts like payroll tax deferrals will face bigger bills next year, possibly complicating an already-challenging climb out of the Covid crisis.

In recent 10-Q filings and investor calls, companies have started to outline some of the hundreds of millions of dollars worth of immediate cash benefits reaped from the tax holiday, even as they warn about the headwinds it may create when the bills eventually come due. In other words, the quick-fix measures hold some potential risks.

"While this may be good for a short-term cash flow, it may backfire," said Cameron Hess, a tax attorney with Wagner Kirkman Blaine Klomparens & Youmans LLP in Sacramento, California. Instead of making prudent cost cuts, employers "are now under an even more serious financial crisis, with obligations owing to the U.S. Treasury."

Recommended For You

To avert the impending economic ruin from the Covid-19 outbreak, U.S. lawmakers in March came together in a rare show of speed and political unanimity to enact an economic relief bill aimed at saving jobs and businesses. The resulting CARES Act included stimulus checks and paycheck-protection funds—and gave businesses the option to defer payroll taxes.

But while companies hit pause on payouts, the meter is still running. Unpaid payroll taxes will total an estimated $211 billion this year, according to analysis by Congress's Joint Committee on Taxation.

Here's how the tax vacation works: The relief package allows companies to defer their portion of Federal Insurance Contributions Act, or FICA, taxes for Social Security and Medicare. Employers pay 6.2 percent of an employee's check to Social Security and 1.45 percent to Medicare. For companies that choose to defer these taxes in 2020, the CARES Act requires businesses to pay back half of the bill next year and the remainder in 2022.

Separately, President Donald Trump has tried to implement an executive order that would allow companies to defer, until the end of the year, the portion of Social Security taxes that workers themselves pay. The measure, seen by tax experts as tied more to re-election efforts than economic benefits, has largely fizzled because it would leave companies ultimately responsible for unpaid taxes.

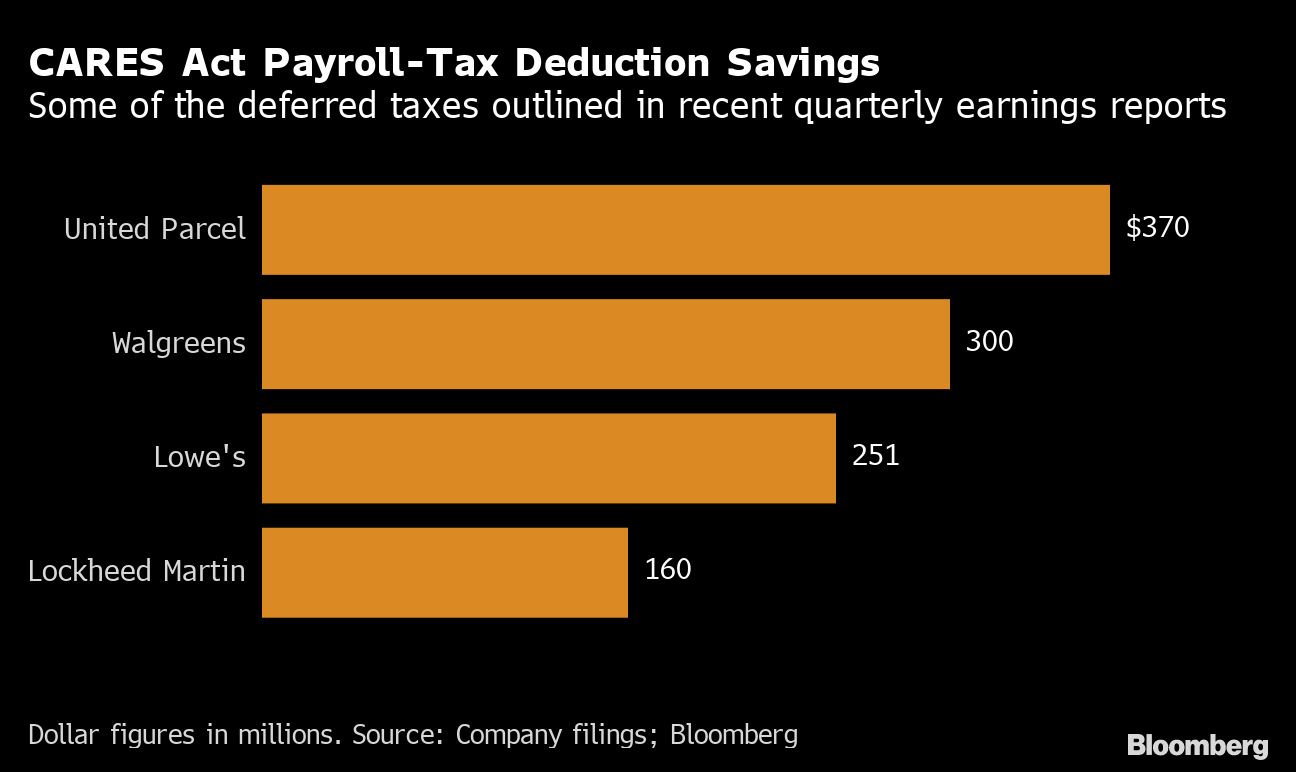

Companies that participated in the tax reprieve saw big benefits in the second quarter. Drugstore giant Walgreens Boots Alliance Inc. booked $300 million in extra cash, United Parcel Service Inc. kept $370 million, home-improvement supplier Lowe's Cos. got $251 million, and Lockheed Martin Corp. says it has an extra $160 million thanks to skipped payroll tax payments.

Presuming the companies defer similar amounts across the final two quarters of calendar year 2020, as the law allows, estimates give an even greater sense of the significance of the savings. On that basis, companies such as Lowe's and UPS would be deferring amounts equal to more more than 10 percent of their prior-year cash flow.

Some of these companies have been clear about the give-and-take nature of the tax deferral. Lockheed's CFO, Ken Possenriede, said it provided both a tailwind and a headwind. "Our headwind this year is the payroll tax deferral—that's $460 million," he said at an investor conference in June. "We have to pay $230 million of that back in 2021 and another $230 million of that in 2022."

CARES Act Averted Shutdowns

Lawmakers didn't have much time to consider the long-range effects of the tax deferral. In late March, the U.S. had a major financial crisis brewing. Small businesses, along with whole industries, were facing a shutdown as states started to adopt stay-at-home orders.

"The CARES Act was a swift response at a time when the economy needed just that," said Erica York, an economist with the Tax Foundation. "It did a good job to help bridge the gap that businesses and households were facing due to the halt in economic activity."

Many companies, including Chipotle Mexican Grill Inc., took advantage of the deferral option. In the second quarter, the restaurant chain booked $6.2 million in cash benefits from payroll tax deferral. It wasn't a huge transfusion, but was just the medicine Chipotle needed, CFO Jack Hartung said.

"This contributed to our ability to invest in our employees in the form of assistance pay, discretionary bonuses, and other benefits while sales and profits fell in the early weeks and months of the pandemic," Hartung said via email.

If Chipotle defers the same amount over the next two quarters, it will see a $18.6 million cash boost this year, which makes for a future tax bill that is $18.6 million larger. For perspective, that represents about 2.6 percent of last year's cash flow from operations.

"We fully expect to be in a position to satisfy the deferred obligation when due in 2021," Hartung said.

AT&T Inc., which has 246,000 employees, cited CARES Act provisions as helping it reach free cash flow of $7.6 billion in the second quarter. "Cash flow was impressive even during the pandemic," CFO John Stephens said on the company's earnings conference call.

This is attractive to a lot of big companies, said Tom Cryan, a partner at law firm Miller & Chevalier: "Larger employers are viewing this as a free loan that they can use for cash flow purposes and pay it back without interest over the next two years. It's a no-brainer."

Some Reject Payroll Tax Deferrals to Avoid Stigma

However, not every company opted for the payroll tax deferrals. Executives worried it might be a seen as a stigma, raising questions about the organization's financial health. Or, for some, it was a decision not to carry the liability, said Mark Mazur, director of the Urban-Brookings Tax Policy Center.

Network-gear maker Ciena Corp. hasn't used any of the federal Covid relief measures. The tech sector is only now feeling some of the spending cuts that have been rippling through the economy. Industries like travel and hotels have been really hard hit, said Gary Smith, Ciena's CEO. "It's more appropriate for those folks who have some short-term liquidity challenges," Smith said.

With the pandemic nearing a global death toll of 1 million and infection rates stubbornly still on the rise, the extent of economic fallout is hard to fathom. Here in the United States, early relief measures provided help to many businesses, but the long-term effects remain unknown.

"Things would be drastically different if we hadn't had the flood of liquidity in the system from the CARES Act," said Mazur. "On balance, it has been more positive than negative. But there are going to be unintended consequences that we haven't even anticipated."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.