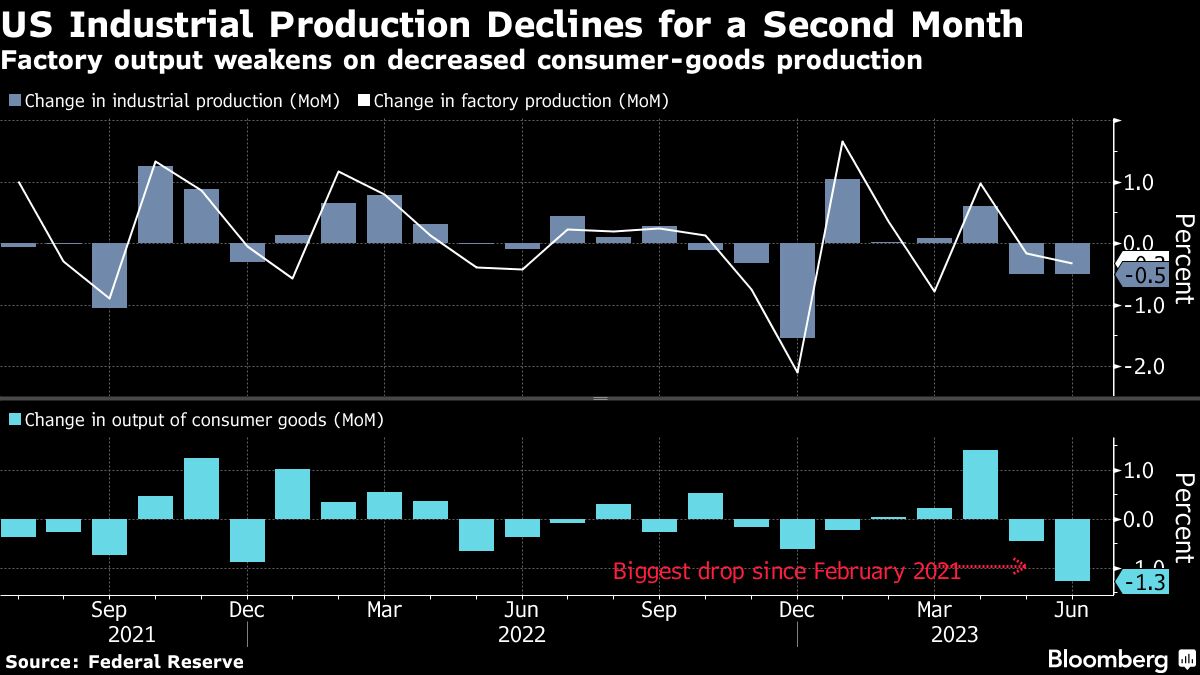

U.S. industrial production fell last month in a broad retreat, reflecting a decline in manufacturing output against a backdrop of uneven goods demand. The June index of production at factories, mines, and utilities decreased 0.5 percent for a second month, Federal Reserve data showed Tuesday. Manufacturing output declined 0.3 percent in June, the most in three months.

After steadily advancing from 2020 through early 2022, the Fed's gauge of manufacturing output is down 0.3 percent from a year ago. Production has been restrained by lackluster export markets, efforts to work down inventories, and more limited consumer spending on merchandise.

Recommended For You

Output of consumer goods dropped 1.3 percent last month, the most since February 2021, reflecting decreased production in a broad range of categories including autos, appliances, and apparel. Output of materials also fell, while business equipment production was flat.

| Metric | Actual | Median estimate |

|---|---|---|

| Industrial production (month-over-month) | -0.5% | +0.0% |

| Manufacturing output (month-over-month) | -0.3% | +0.0% |

Still, manufacturing may benefit some in coming months as retailers get inventories more in line with sales and the pace of goods inflation slows.

Separate data on Tuesday showed retail sales rose by less than forecast, while an underlying measure of household spending pointed to a more resilient consumer at the end of the second quarter. According to the Fed's production data, utility output decreased 2.6 percent, while mining eased 0.2 percent.

Capacity utilization at factories, a measure of potential output being used, dropped to a three-month low of 78 percent. The overall industrial utilization rate slipped to 78.9 percent.

Survey data have painted a more dire picture of factory activity. The Institute for Supply Management's manufacturing gauge in June dropped to the lowest level since May 2020. S&P Global's index also showed activity falling at a faster rate.

—With assistance from Kristy Scheuble.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.