Twenty-eight years ago, a groundbreaking article in the Harvard Business Review articulated a novel idea for how organizations could “re-engineer” their business processes by using “bank credit cards” to make procurement of low-value goods work better, faster, and cheaper. Since that time, the use of purchasing cards (p-cards) has grown so rapidly that the cards now represent a new normal in the way North American businesses pay for low-value goods and services. Market estimates indicate that spending on p-cards has grown from near zero in 1990 to more than $350 billion annually.

Accordingly, commercial issuers have continuously upgraded card technology, including significant improvements in controls to support increasing demands for enforcement of spending policies. More recently, issuers and technology providers have promoted the concept of transforming accounts payable (A/P) from a cost center to a profit center, principally by improving liquidity, reducing manpower, and obtaining card-issuer incentive cash.

These trends notwithstanding, our research over 25 years indicates that although the p-card value proposition remains true and valid, significant challenges to successfully implementing a p-card program continue to reduce the benefits companies are actually achieving. The overall p-card market in North America is robust, but a high proportion of that spending is conducted by only a small fraction of p-card adopters.

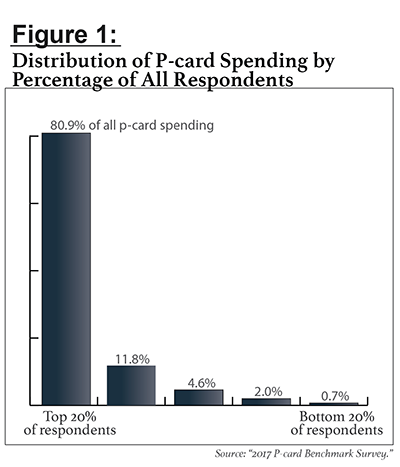

In general, in any industry or company size category, a small segment of card-using organizations comprise the bulk of spending. Across our 2017 survey, we found an 80:20 pattern. (See the sidebar About the Survey, below.)

In general, in any industry or company size category, a small segment of card-using organizations comprise the bulk of spending. Across our 2017 survey, we found an 80:20 pattern. (See the sidebar About the Survey, below.)

As Figure 1 illustrates, 20 percent of survey respondents were responsible for 80.9 percent of the total spending reported across all participants. In fact, the top 40 percent of respondents generated 92.7 percent of total p-card purchases, while the bottom 60 percent generated only 7.3 percent of spending. A similar pattern exists within each market segment, as determined by company size or industry.

The root causes of p-card program underperformance are a matter of speculation, but it is safe to say that many organizations, after making the decision to adopt card-based payments for goods and services, have found the implementation to be challenging. In this respect, the implementation of p-card programs is similar to other major technological changes, the majority of which fail to deliver the promised value.

Benefits of an Effective Card Program

The argument for the use of p-cards is compelling. Survey respondents indicated expectations that a p-card program could provide:

- Savings on transaction costs. Respondents estimated that the administrative cost of procuring and paying for a good or service is 78 percent lower when the purchase is made using a p-card, falling from $89.99 per transaction via a traditional, paper-based purchase order process to $20.14 for a transaction via p-card.

- Process simplification. According to our 2014 p-card survey, the traditional purchase order method requires an average of 2.3 approvals for a $2,000 payment, while a similar p-card-enabled transaction requires only 1.4 approvals (a 39 percent reduction).

- Increased working capital. A typical p-card transaction provides 29 days of float; the working capital savings associated with p-card purchases are equivalent to a 0.4 percent discount on the price of the purchased goods and services.

- Cycle time savings. The average procurement cycle time—from need identification to receipt of goods—is 71 percent shorter when the transaction is paid for using a purchasing card. Our survey indicates the procurement cycle is 9.9 days via the traditional purchase order-based process but only 2.9 days via p-card.

- Rebates. The vast majority of card-using organizations (82 percent) received a rebate for p-card spending in the past year. Organizations that do get a rebate spend significantly more via p-card and direct more of their low-dollar transactions to the p-card for payment.

- Other benefits. P-cards also lead to less reliance on checks, discounts based on p-card data, reductions in petty cash accounts and cash advances, and the avoidance of late fees or lost discounts.

Any reduction in procurement costs that a p-card program can generate will boost the organization's bottom line, directly increasing net income.

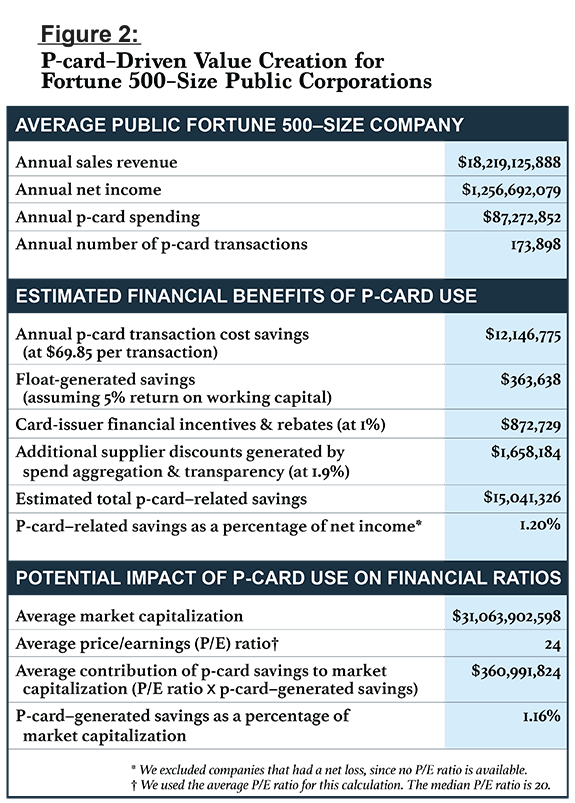

To highlight this effect, we analyzed net income and market capitalization figures, along with p-card savings, for the publicly traded Fortune 500–size companies represented in the survey.1 Figure 2 shows that these companies have, on average, annual revenue of $18.2 billion, and they spend an average of $87.3 million on p-cards annually. As a result of this spending, the average company generates annual cost savings of $15 million, which improves corporate profitability by 1.2 percent. The $15 million savings figure is an ongoing annual realization of the efficiency of the procurement process, not a one-off savings event.

Figure 2 extends the analysis further, to estimate the impact of p-card–generated savings on the company's market capitalization. For this calculation, we multiplied the savings by the company's stock price–to–earnings, or P/E, ratio. The result of this calculation reflects the impact of p-card savings on the market valuation of the company. As Figure 2 demonstrates, ongoing p-card–related savings—which directly impact net income—seem to deliver an increase in market valuation that averages 1.16 percent for Fortune 500–size corporations.

Is Your Card Program Underperforming?

An underperforming p-card program is one that fails to meet organizational expectations with regard to transaction cost savings, cycle time savings, process simplification, reduced need for working capital, rebates, or other benefits. Most organizations focus on the full complement of value attributes but pay particular attention to administrative cost savings, float, and financial incentives (e.g., cash back) provided by the card issuer.

A common problem among underperforming card programs is a misdiagnosis of performance, which delays remedial actions to increase p-card value. Our research shows that for 86 percent of companies whose programs are shown to need improvement based on performance metrics, management has a perception of program strength that is inconsistent with market data.

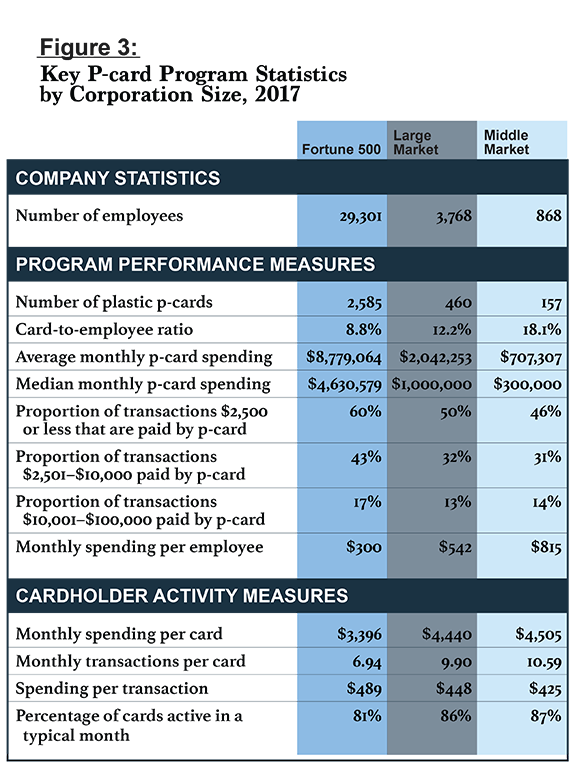

As a first step to optimize p-card performance, an organization should obtain access to benchmark market data about p-card use in organizations of a similar size and type. It should compare and evaluate its own program against this benchmark data. Figure 3, for example, provides spending and card distribution norms for more than 1,300 corporations that responded to our 2017 survey. We've separated the data by company size: Fortune 500–size, which equates to annual revenue of $2 billion or more; “large market,” which reflects annual revenue between $500 million and $2 billion; and “middle market,” with annual revenue between $25 million and $500 million. Similar benchmarks are also computed by industries in which the organization operates.

In addition to comparing their card program against industry benchmarks, executives can stay on the alert for common signs that their p-card program is failing to live up to its potential.

The first and foremost sign, of course, is that spending on the p-card is comparatively limited. Yet an underperforming program sends out many other signals as well. Here are a few to watch for:

- Organizational leaders do not measure or evaluate the progress of the p-card program.

- Accountability for program performance is not maintained, and/or success is not rewarded.

- Employees complain that the p-card is not suited to their spending needs.

- Employee spending behavior indicates a lack of training or knowledge of p-card policy.

- Employees are opting to continue to use the old process.

- Management is overly focused on the potential for p-card misuse.

- The p-card program is static; it is not evolving to reflect changes in the commercial card market.

- P-card data is poorly integrated with other systems in the organization.

- Traditional processes—such as maintenance of receiving documentation when goods are delivered to cardholders—are simply migrated to the card-based process, rather than being redeveloped from the ground up.

- Signs of noncompliant p-card spending activity are poorly monitored, and disciplinary actions are too weak to facilitate necessary control over the process.

- Supply chain partners have not been brought into p-card payment processes.

Causes of Underperformance

Failure to launch a successful p-card program can typically be traced back to a series of missteps that coalesce to undermine card value and/or use. We break these reasons into three categories: acceptance, control, and technology.

The most common reasons why p-card programs languish or decline are:

Issues Around Acceptance by the Organization and Its Suppliers

- Management does not publicly support or articulate a compelling and inspiring reason for p-card use.

- The scope of the p-card activity is limited to a subset of goods and services.

- Resources are inadequate for effective program administration.

- The organization has not developed and disseminated clear policies and guidelines for p-card use.

- The organization does not adequately train employees on p-card use.

- The organization has not developed, or does not measure, key performance indicators to evaluate the progress of the p-card program.

- P-card use is not mandated for a defined group of purchase activities.

- The organization does not have a supplier-enablement strategy.

- The organization has only limited engagement with suppliers to lower the cost of card acceptance.

Issues of Control

- Management is more concerned about potential card misuse than about achieving the benefits of card use.

- Card distribution is limited to a small sect of employees (typically managers).

- Spending limits do not support the cardholders' actual buying needs.

- The organization does not deploy controls in a way that inspires confidence among managers.

- Executives are uncomfortable with the level of detail provided about purchases, even if the need for additional detail is unclear.

- The company does not adequately monitor card use, or potential misuse (e.g., unusual purchases).

- Program organizers have not implemented adequate risk management, such as acquiring insurance against misuse of p-cards.

- Policy fails to clearly describe which card purchases are allowable and which are not allowed.

- Disciplinary policy does not embody a strong deterrent to card misuse or lax supervisory oversight of p-card spending.

Issues of Technology

- Card data is not completely integrated with accounting or expense management systems.

- The organization has not explored other creative card technology options, such as virtual cards.

A Roadmap for Program Rehabilitation

Few technology implementations fully meet every expectation, and p-card programs are no exception. There is a “chicken or the egg” quality to the p-card implementation challenge. Specifically, poorly implemented p-card programs deliver little value in their early stages. Improving the program's performance will require p-card spending to increase, but if the program isn't performing, management may deem it unworthy of continued investment.

The solution lies with information and education. Through more than 20 years of discussions with administrators of high-performaning p-card programs, we have identified nine specific steps that companies can take to transform a lethargic p-card program into a program that delivers significant benefits.

1. Assess the current state of the program, and review the choices that got you there. Objectively assess the current state of your p-card program, using industry-specific benchmark norms and well-recognized best practice configuration options.

2. Find your community. No need to reinvent the wheel. You can get insights from other organizations in the same industry that have overcome barriers to achieve significant and enduring value from p-card use. Seek out this information through interactions at card-industry conferences and by using benchmarks.

3. Address the fear. Educate your organization's leadership team to overcome the fear factor. Many executives operate in a preternaturally defensive mode, focusing on what can go wrong. Card program managers must clearly communicate to management each aspect of the p-card value proposition and every lever of control over cardholder activities. Use data to assess the risks of card misuse, and to weigh those risks against organizational benefits from card use. Have an action plan in place to mitigate the effects should a misuse event occur.

4. Create a “safe space” for p-card use and experimentation. No one will support a program that lacks proper controls or fails to comply with organizational policy. The most effective route for change is to bring known p-card control configurations to the attention of compliance and control advocates in the organization (e.g., internal audit) for review and critique.

5. On-board employees. Employees may be hesitant to jump on the p-card train. Consider a card-distribution policy that prioritizes those individuals who would benefit most from a card, thus creating card evangelists within the organization. Their enthusiasm for the simplicity and benefits of card-enabled purchases may convince others in the organization to want in.

6. Exploit technology. Card data should integrate seamlessly with organizational data; work with your issuer to make that happen. Technologies like data mining not only highlight growth opportunities, but also strengthen control over card use, providing greater comfort to management and users. Meanwhile, virtual cards and mobile applications open a whole new terrain for card capture of spending.

7. Set targets. Define the goals for the p-card program, which may include reductions in cycle time and/or headcount. Regularly measure performance tied to those goals. Develop policies that encourage p-card use as the company's preferred payment option.

8. On-board suppliers. If card users report that suppliers are reticent to accept card payments, start a dialogue to inform suppliers about how they can benefit from supporting greater p-card use by your employees.

9. Report progress, and celebrate success. Communicate the p-card program's progress toward the goals set forth, as well as any course corrections. Celebrate the successes.

While corporate p-card spending around the world continues to outpace the growth of national economies, many programs are underperforming, as casualties of a flawed implementation strategy. Organizations that fail to compare their program's progess against benchmarks will have limited ability to see implementation problems—and so limited ability to take corrective action.

Effective card-program implementation is built on fundamental components of p-card value: internal and external acceptance of cards, appropriate program controls, and leveraging available technology. Based on our data, many companies drive significant dollars to, and reap significant rewards from, p-card purchases based on attention to these fundamentals. However, initial p-card implementation efforts often fall short of expectations.

Champions of p-card programs that do not compare well against industry norms can and should take the basic steps necessary to get their programs back on track. Such an intervention is well worth the effort, because continued growth of a p-card program has the potential to deliver notable value to the organization.

1. NOTE: We focused on Fortune 500-size public companies because of data availability. To provide a representative look at organizations in this group, we removed businesses that are anomalistic, either because annual revenue is unusually large or because p-card spending is either unusually large or small relative to the rest of the group.

Dr. Mahendra Gupta serves on the faculty of the Olin School of Business at Washington University in St. Louis, where he is the Geraldine J. and Robert L. Virgil Professor of Accounting and Management. His research has been published in leading academic journals. He has served on several editorial boards and has been a frequent speaker at research workshops and conferences worldwide. Gupta has been a consultant to various firms and government agencies and serves on various corporate and not-for-profit boards.

Dr. Mahendra Gupta serves on the faculty of the Olin School of Business at Washington University in St. Louis, where he is the Geraldine J. and Robert L. Virgil Professor of Accounting and Management. His research has been published in leading academic journals. He has served on several editorial boards and has been a frequent speaker at research workshops and conferences worldwide. Gupta has been a consultant to various firms and government agencies and serves on various corporate and not-for-profit boards.

Richard J. Palmer is a professor of accounting and Copper Dome Faculty Research Fellow at Southeast Missouri State University. He is a frequent speaker at commercial card conferences and the co-author of numerous articles about industry use of e-procurement tools and bank commercial cards. Palmer's insights on card use have been quoted in popular North American news outlets such as the Wall Street Journal, ABC News Good Morning America, CNN Money, and CBS News MarketWatch.

Richard J. Palmer is a professor of accounting and Copper Dome Faculty Research Fellow at Southeast Missouri State University. He is a frequent speaker at commercial card conferences and the co-author of numerous articles about industry use of e-procurement tools and bank commercial cards. Palmer's insights on card use have been quoted in popular North American news outlets such as the Wall Street Journal, ABC News Good Morning America, CNN Money, and CBS News MarketWatch.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.