Given the complexity of mergers and acquisitions (M&A), it's understandable that organizations often focus exclusively on executing the deal, which typically includes coordinating changes with lawyers and initiating the transactions needed for closing. However, companies should also use the deal-planning stage to develop a roadmap to combine the operational and strategic aspects of a treasury integration. Doing so can help position the combined organization for lasting transformation following an M&A deal.

Each treasury organization is unique, but the end goal following a merger or acquisition remains the same for all: to optimize cash management by leveraging the strengths of both companies.

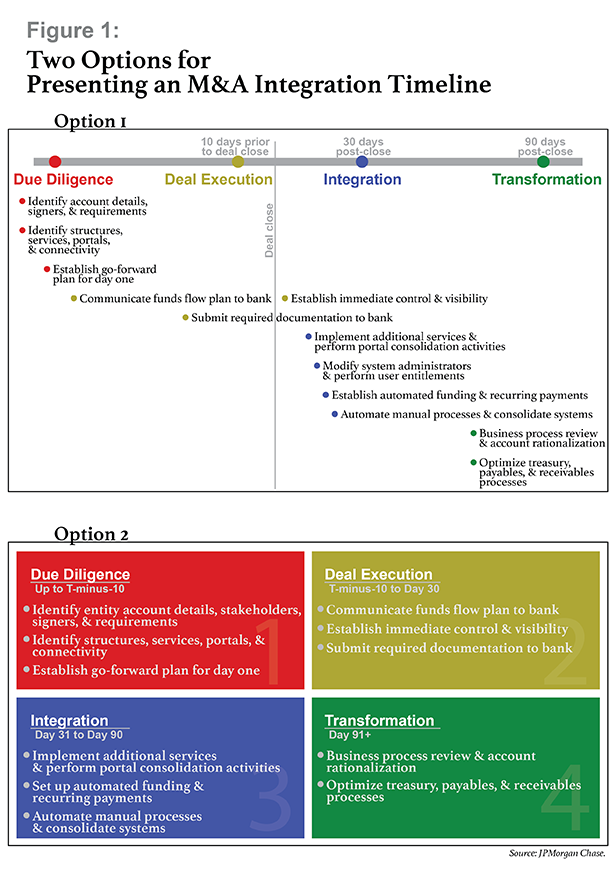

An M&A transaction creates an opportunity to combine two unique treasury organizations—each with its own processes and platforms—in a way that optimizes efficiency. Regardless of each treasury team's beginning state, it's important to formulate a roadmap that organizes the expected milestone events of the transformation journey, such as those in Figure 1 (below).

The roadmap should address specific actions that both treasury teams need to take, along with the specific time period for each action. It should start with the due diligence and deal execution details that are usually the focus of a finance team's acquisition-related activities. To ensure that due diligence and execution are effective, the treasury group should involve banking partners early in the project planning and establish sponsorship of the project among senior leadership. The treasury team also needs to plan project management oversight of due diligence processes and integration activities prior to the deal, establish goals for the integrated organization, and prepare contingency plans for funds movement.

There are several potential pitfalls treasurers should try to avoid in this phase of the project. These include a lack of templates and/or forums for sharing information, and a lack of ownership from key resources and other stakeholders. Another common problem is delayed communication to impacted parties, including banking partners, of day-one expectations and projected changes to treasury processes.

Treasury's pre-close transition planning is crucial. So are the integration and transformation activities, which start after the deal closes. The integration and transformation processes present treasurers with an excellent opportunity to set up their combined organization for long-term success. Post-close integration can be roughly divided into three groups of activities, each with its own key objective:

1. Operational Integration: Visibility and Control from Day One

In a roadmap for integration of multiple treasury functions, the initial steps should be operational in nature. This is the time for the treasury groups to combine their day-to-day activities. Ideally, in doing so, they will also clean up any accounts or processes that are redundant or outdated.

As soon as possible after the deal closes, treasury leaders must gain visibility into, and control of, all accounts across both organizations' banking relationships. One part of this process involves submitting legal documentation to the banks requesting changes to authorized-signer lists. Just as important is making sure all necessary users are added, with the appropriate permissions, to each organization's online banking portals. Updating the online portals' user credentials ensures that the employees who are staying with the combined company will be able to perform cash reporting and transaction initiation functions. It also gives the new treasury leadership team the ability to update security settings, remove inactive users, and eliminate products linked to inactive accounts. Establishing user groups, each with its own set of controls and transaction limits, helps streamline ongoing management of permissions within banking portals and other treasury systems.

An M&A integration is also an excellent opportunity to ensure that fraud protection is consistent across accounts and that security measures are providing optimal protection to the larger firm. Treasury staff should work with the IT security team to ensure that each account has all the right fraud protection settings turned on. At the same time, treasury should be involved in updating the company's email policies so that messages from outside the company get flagged as "external." This raises a red flag for accounts payable (A/P) clerks and others who might be targeted in phishing or impostor fraud schemes; it is an added safeguard against financial cybercrime.

In addition, a company combining treasury teams should consider implementing multi-bank reporting and multi-bank payment initiation where needed. Finally, this is a great time to consider implementing a new cash concentration structure, such as a zero-balance account (ZBA) structure.

Treasury groups that fail to optimize efficiency during an M&A transition often overlook opportunities to streamline processes during the operational integration. For example, they may fail to remove redundant or unused banking services, products, or features. They may also fail to root out and close any unused or dormant bank accounts. Treasury teams should reach out to their banking partners for ideas on creating efficiencies during this part of the M&A transition.

2. Strategic Integration: Efficiency and Scale for the Long Term

As the operational integration proceeds, the combined treasury team should also take a strategic look at how to optimize their activities. Technology is a central component of any strategic treasury integration. Treasury leaders should ask themselves: What are the organization's long-term operating needs for enterprise resource planning (ERP) and treasury management system software? Is the consolidation of existing systems an option?

With the visibility gained through the operational integration, treasury leaders should review all the combined company's disparate processes to identify manual activities that could be automated. For example, could implementing host-to-host (or SWIFT) connectivity improve the efficiency of payment processing and balance reporting? In what other areas could technology make the organization more efficient?

With the visibility gained through the operational integration, treasury leaders should review all the combined company's disparate processes to identify manual activities that could be automated. For example, could implementing host-to-host (or SWIFT) connectivity improve the efficiency of payment processing and balance reporting? In what other areas could technology make the organization more efficient?

Explore whether the company could make vendor and payroll payments directly from an ERP system, perhaps via a single payment file. Look into consolidating receivables into one file, automating cash application, and pursuing a remittance-matching service.

Digging even deeper into the purchase-to-pay and order-to-cash cycles might reveal a better approach for integrating the two organizations' invoicing, procurement—including supplier preferences, terms, and settlement type—and other functions. It is mainly a matter of having centralized processes across both organizations so that key personnel are following standard procedures and protocols. Areas in which treasury teams may find opportunities to increase efficiency include electronic invoicing; moving to electronic forms, as opposed to paper, wherever possible; standardizing preferred vendor lists; and deploying companywide protocols for vendor on-boarding.

Similarly, a deep-dive review of bank providers and accounts is an opportunity to identify redundancies and rationalize the combined organization's bank accounts. Having fewer accounts at fewer banks can generate cost savings and uncover pricing advantages because doing so will increase the company's volume with each individual provider. Plus, reducing the complexity of the corporate banking structure can streamline regulatory reporting.

As the treasury leadership team works to determine the right approach for bank account rationalization, they should look at establishing a standard set of performance indicators that can provide a framework for measuring success. Some examples of key performance indicators (KPIs) that are useful in bank account rationalization include:

- percentage of cash that is visible to central treasury

- percentage of account balances that are reported centrally

- error percentages for cash forecasts

- bank counterparty risk

- percentage of payments completed via straight-through processing

- percentage of corporate revenue spent on bank fees

3. Transformation: Optimizing for the Future

With consolidation and automation plans under way, treasury leaders can focus on redeploying treasury staff members to responsibilities that add more value to the organization. For example, experienced treasury professionals might be asked to focus on analyzing treasury data, strengthening governance, establishing procedures and controls, foreign exchange (FX) hedging, leveraging data for treasury decision-making, and preparing due diligence for anticipated future M&A activity.

Even after the treasury groups have fully integrated from the operational and strategic perspectives, they need to keep looking for areas of improvement. The initial integration is only one aspect of the transformation journey; an M&A transaction presents excellent opportunities for a treasury group to enhance processes and refine its structure. After the integration is complete, continued transformation of a treasury function could include:

- Reviewing and mapping business processes to identify ways to increase automation and streamline activities. At a high level, procure-to-pay in A/P and invoice-to-cash processes in accounts receivable tend to offer opportunities for improvement. This may boil down to boosting efficiency in payment workflows, utilization of the combined company's ERP system, remittance matching and association, and invoice management.

- Optimizing working capital. Treasury groups should look at ways to consolidate payment and receivables processes, to improve days payables outstanding (DPO) and days sales outstanding (DSO), respectively. Generally, these improvements are possible through centralizing operations and establishing clear procedures. Treasury teams should also look at closing any gaps within their existing processes that may be causing delays in cash application or payment processing.

- Leveraging access to a greater pool of data. For example, treasury may be able to tap into better information on FX rates (or rates in general), the company's time to process payments and receivables, bank fees, and error rates. The treasury team should also be looking to ensure that all the data they rely on is available in real time.

- Exploring prospective benefits of new technologies. Robotic process automation (RPA) can significantly improve efficiency, and application programming interfaces (APIs) can enable real-time treasury capabilities. These technologies can prove particularly beneficial for lean treasury organizations that have minimal IT support, treasuries that are electronically inclined for payables and receivables, and treasuries that consider themselves "digital" today.

- Pursuing forward-thinking centralization initiatives like establishing an in-house bank, shared services center, or regional treasury center. Such initiatives are most likely to help organizations that have closed multiple acquisitions through the years with various cash management staff. They also may be particularly beneficial to companies with significant activity in the Asia-Pacific region and for businesses with pay-of-behalf-of (POBO) and/or receivables-on-behalf-of (ROBO) structures in place.

Meeting all of these milestones requires senior-level sponsors to shepherd the plan through to execution—helping, among other things, with securing funds for optimization projects and ERP upgrades. To secure executive sponsorship, treasury leaders should make their requests clear and actionable, putting forward a solid project timeline/outline with concise calls to action for senior staff.

See also:

- The Importance of a Treasury Acquisition Strategy

- Is Your Treasury Organization Ready for an Acquisition?

- 5 Drivers of Success in M&A

- Risk Management Pitfalls in M&A

It's also important to pay close attention to project management, for effective coordination of execution across the different elements of the treasury roadmap. Integration and transformation efforts require solid planning and timelines with clear milestones. Leaders should clearly list priorities and develop a prioritization map, accounting for areas including online portal consolidations, centralization and consolidation of payables and receivables processes, ERP changes or upgrades, and implementation of connectivity and payment transmissions.

The integration activities and ongoing treasury optimization initiative will serve as a valuable model from which to learn to support the future growth of the newly combined company.

James Wilkinson is vice president of corporate treasury consulting, commercial banking, for JPMorgan Chase. The JPMorgan Corporate Treasury Consulting team can support clients on their treasury transformation journey, helping build a roadmap that works for their organization.

James Wilkinson is vice president of corporate treasury consulting, commercial banking, for JPMorgan Chase. The JPMorgan Corporate Treasury Consulting team can support clients on their treasury transformation journey, helping build a roadmap that works for their organization.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.